Welcome to this weekly recap, I am Viktor and you can find me here on Twitter and here on Telegram. Enjoy your reading !

$BTC and the market overall

This week, $BTC has been mostly ranging, between $41k and $44k, and it is currently at $44k. My expectation is that we will keep ranging during the last 10 days of 2023, but we are really in the middle of nowhere in terms of high timeframe technical analysis. We could go back to $32k and then bounce, and we would still remain in an overall uptrend. But we could also not have any meaningful correction in the short-term…

“Sell the news” after ETF approval remains the most likely scenario. In the short-term, I am neutral-bullish, and ready to buy any dip, even until low $30k-ish.

BTC.D is at 53.6%, and ETHBTC made a new low yesterday under 0.05, and is now back at 0.051. I don’t think $ETH can shine before the ETF is approved, so this ETHBTC bleed is logical. $ETH stands at $2250 right now.

What we can notice, though, is that we are already in the middle of a memecoin mania, after 2 months of market pump, so traders are going down the risk-curve, which is a sign that the market is frothy, and could have a reset soon. Be careful, but I really don’t recommend to short this market, especially if we are right in the beginning of a new bull run.

Winners keep winning :

The 4 coins that have been showing strength consistently during the last 2 months did all reach new yearly highs this week : $SOL, $INJ, $AVAX, and $TIA.

Solana $SOL :

$SOL reached $87 today, which makes it the 5th coin by market cap, still behind $BNB, but it has now flipped $XRP. I don’t have much more to say about $SOL than what I wrote about it during the recent weeks. I think it is the most obvious long behind $BTC and $ETH and will remain it during the whole bull cycle. It seems extremely risky to call tops on $SOL, but in the same time, it is a top 5 coin that is up more than 4X in three months, so it is very reasonable to take some profits on SOL perp longs if you do have one (it is trickier to sell spot in my opinion, because it is psychologically harder to re-buy). $SOL is now only 3x from its ATH, so don’t set crazy expectations in terms of price appreciation : I can see this do another 10X (this would be a $300bn market cap at the top of the bull run), but that is about as high as it could go.

As long as the current overall market trend is not exhausted, though, $SOL is likely to continue outperforming. But at some point we will probably have a serious correction, and this moment will probably be a great opportunity to buy a dip on $SOL.

As usual, when $SOL performs well, the Solana ecosystem do too, such as $RAY (+60% this week), $ORCA (+33%), $HNT (+36%), $NEON (+70%), and of course $BONK that I will write about below.

Injective $INJ :

$INJ is also up +30% this week, and reached a local top at $43, which corresponds to a $3.6bn market cap. $INJ is now a top 25 coin, while it was ranked #166 in terms of market cap one year ago. Could the playbook be “wait for $INJ to get in the top 10 and then dump it ?”. Considering its strength, $INJ is likely to keep climbing the rankings.

In typical crypto fashion, $INJ has a ridiculous TVL of not even $20M. I have the feeling that people are finally chasing higher beta in the Injective ecosystem, ie NFTs and memecoins on Injective… Being early on these plays is usually very rewarding.

Celestia $TIA and Avalanche $AVAX :

$TIA reached a new ATH at $14.5, but is mostly flat this week overall. $AVAX is also at its new yearly high, at $46. We are really running the exact same SOLAVAX playbook again…

$SEI and the EVM parallelization narrative

One of the shiny new coins of the year has been the best performer this week in the top 100 : $SEI is up +60% this week, and went from $0.25 to $0.40. I have already written my thesis on $SEI in another edition of this newsletter a few weeks ago, but let me state it again : alt L1 + new coin with price discovery potential + Cosmos has been hot recently + market cap and FDV are still “small” + could be considered as “new Solana” + some smart people started mentioning it.

I will also add a new bullish catalyst about Sei : it is one of the projects that is trying to do “parallelized EVM”, which more or less means Ethereum virtual machine but with fast and cheap transactions, and the monolithic view (like Solana) instead of the modular view. The most eagerly awaited parallelized EVM project is Monad, but it has not launched yet, and people might simply long $SEI instead of waiting for Monad launch.

$WLD, $ICP, short squeeze and hated coins

This week, we have also witnessed the short squeeze of one of the most hated coins : $WLD. The first squeeze went from $2.7 to $3.3, but then there was a second one even more violent, from $3.3 to $4.6. It then dumped but went back to $4.6 the day after, and is now down to $3.6 again.

The reason why $WLD is a very hated coin is because its FDV is absolutely gigantic. $4 means a $40bn FDV, but the float is extremely low (1%), which means only $400M market cap. This implies that the price can squeeze violently, and we can reach a stupid FDV without difficulty. When you consider the fact that Sam Altman is behind it, and that it has this reputation of squeezable hated coin, I think $100bn FDV is on the line.

You might remember that I have been short $WLD almost since its launch, and my mental stop loss has been hit during this squeeze. The FDV is stupidly huge (almost equal to $SOL FDV), but the float is sooo low that this can easily pump with some momentum, so this is why I closed the short.

The main reason for the pump this week is something related to the new updated market maker contracts, you can read about it in these 2 tweets by thiccy and DefiSquared :

The second hated coin rally of the week has been $ICP. This one pumped almost 2X from $6 to $12, but now dumped back to $9. I have been short $ICP too, and this one is more comfortable because the market cap is huge (>$4-$5bn), and as I consider this coin as pure vaporware, I just don’t see it outperform. My thesis for the short : I have not seen any activity on $ICP + almost no one is long this coin (=no mindshare) + the price action has been down only since its launch + it still remains in the top 25 despite this, so it seems over-valued.

$BONK, a $10M-PnL, and a new memecoin mania :

$SOL is reaching new yearly highs this week, and as the official mascot of the network, $BONK did too. Both Coinbase and Binance listed $BONK, and this ignited the last leg (?) of this run for $BONK, which reached a $2bn market cap.

An anon on Twitter who entered a long on $BONK very close to its bottom has documented the evolution of its uPnL on Twitter, and it went as high as $12M around the $BONK top. The anon also wrote a thread to explain why he does not plan to close its trade :

Someone with a gigantic uPnL explaining on Twitter why he does not want to sell is usually a good top signal. $BONK is currently down -45% from its ATH, and is clearly in a downtrend with lower highs and lower lows. I expect it to bleed more, after such a gigantic run.

As I wrote last week, the $BONK pump has given strength to a new dog coin / memecoin mania, and one of the main winners has been $WIF, “dog wif hat”, another dog coin on Solana that is around $300M in market cap. We can also mention $COQ, the leading memecoin on Avalanche, that reach $250M in market cap too. The main memecoin on Arbitrum seems to be $NOLA.

We are currently in memecoin season, especially on Solana, just like what happened after the $PEPE run in May.

What else happened in the market :

DePiN (decentralized physical infrastructure) is a category that I don’t know much about but some of these coins have performed very well this week : $HNT (Helium token, which is on Solana, so it also benefits from the Solana strength), $MOBILE (+120%, it is a “subtoken” of the Helium project), $STORJ (+50%), $LPT (+47%), $IOTX (+86%), $FIL (+13%).

$NEAR is a 2021 alt L1 that does not seem to have much mindshare and yet is one of the best performers of the last 2 months. This week, $NEAR is up almost +50%. One of the reasons for this strength could be Near DA (Data Availability), which is (from what I understand) an alternative to Celestia DA or EigenDA, and as $TIA has been performing well, $NEAR is benefitting from this narrative too ? I am not sure, though.

$STX, the main L2 (Stacks) on bitcoin, is up +34% this week. It has been an “obvious long” since October, but did not really show strength until the beginning of December. A large update, the Nakamoto upgrade, is planned for Q1 2024, and is a good catalyst for $STX, in addition to the overall market focus on $BTC with the ETF and the halving. The “STX beta coin” $ALEX performed well too.

A few Cosmos coins have had a good week again : $AXL (+20%, it is an IBC bridge), $OSMO (+22%, the liquidity hub of Cosmos), $EVMOS (+25%, Cosmos + EVM coin), $SOMM (+38%, yield strategy hub).

Longing new coins launched in 2023 on Binance and that have recovered nicely from their lows is in my opinion a good strategy : $ARKM (+43% this week) and $MAV (+22%) are two coins that are exactly in this category and that performed well this week. I prefer $MAV over $ARKM though, because Maverick Protocol has strong fundamentals as a DeFi project.

$ACE (Fusionist) is a new token that launched on Binance this week. I don’t know anything about this project, except that it is already highly capitalized with $400M MC and $2.4bn FDV.

Some good tweets / threads :

Unsustainable setup right now ?

Recent market runners :

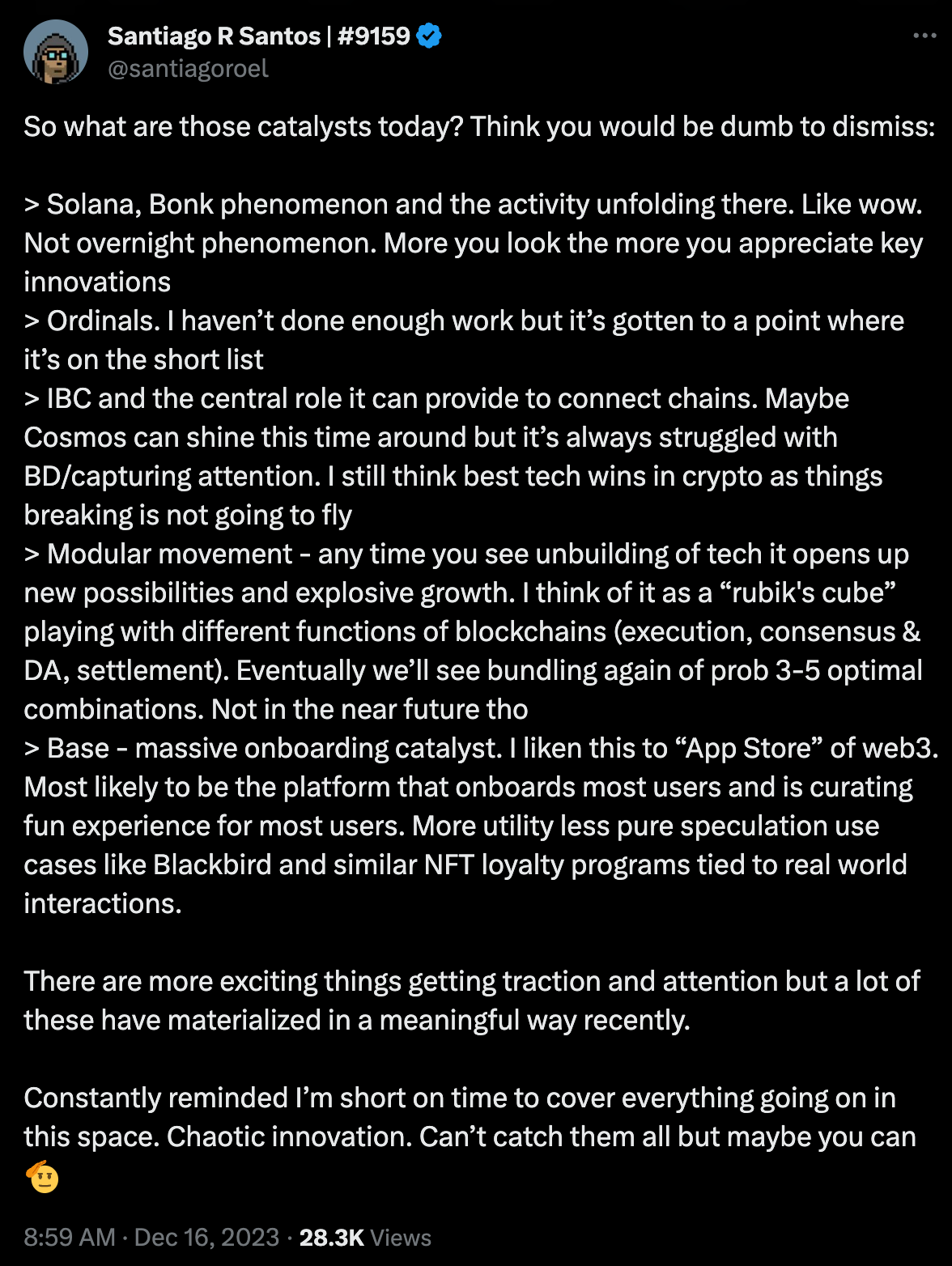

Solana catalysts :

Dream bigger for BRC-20 :

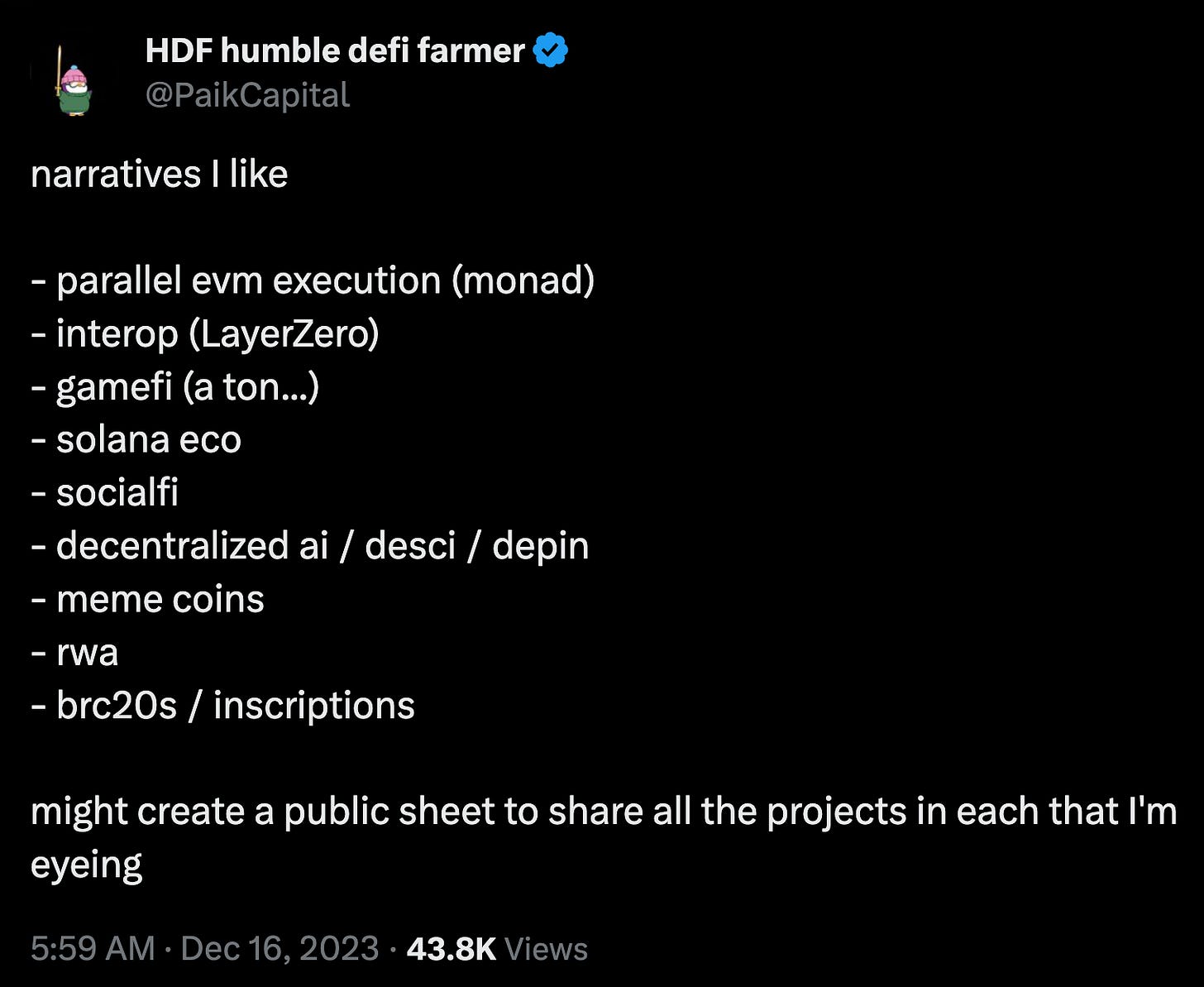

List of crypto narratives :

Uncertainty in the market :

Narratives ranked by attention (posted on Dec 6, fyi) :

Long and strong Alex Wice strategy :

Long-form tweets by Tyrogue (click to read more) :

Difference between vs memecoins and mascots :

How to compound trends :

Long-form tweet by the BananaGun trading competition winner :

The danger with waiting for Fed pivots :

Local top ?

Reasons to remain bullish :

The historical significance of the recent Solana mania :

EMA tip for newcomers :

Trading advice by Eugene (Binance leaderboard trader) :

Thank you for reading this article,

Cheers,

Viktor.

P.S. : If you liked this recap of the crypto narratives of the week, I would be pleased if you could share it to some friends that could be interested too ! I've enabled Substack referrals, so you can use your referral link, and if you refer people, you are entitled to rewards (USDC). See the leaderboard here.

Best newsletter. Other guys paid letters are much less than yours. Level up and make it paid! Thanks

LOVIMG IT !!!

thank you so much for doing this for free ... ❤❤❤❤❤❤❤❤❤