Narratives of the week : November 29

Gaming narrative / $600M in Blast / new coins good / UST 2.0

Welcome to this weekly recap, I am Viktor and you can find me here on Twitter and here on Telegram. Enjoy your reading !

$BTC and the market overall

This week on $BTC has been very similar to the 3 last ones. We are exactly in the same range, but we are making higher lows, as $BTC is respecting the trendline. There have been a few attempts to properly breakout from the $38000 but we’ve been rejected 3 times at $38500 and $BTC currently stands at $37900. All the dips are shallow, I think it is very likely that we see $42k before the ETF approval.

TradFi in particular seems to be very long $BTC, because the BTC CME futures OI is higher than ever at $4.4bn right now. In the same time, GBTC premium is getting very close to 0, it is now at 8% while it was almost -50% around one year ago.

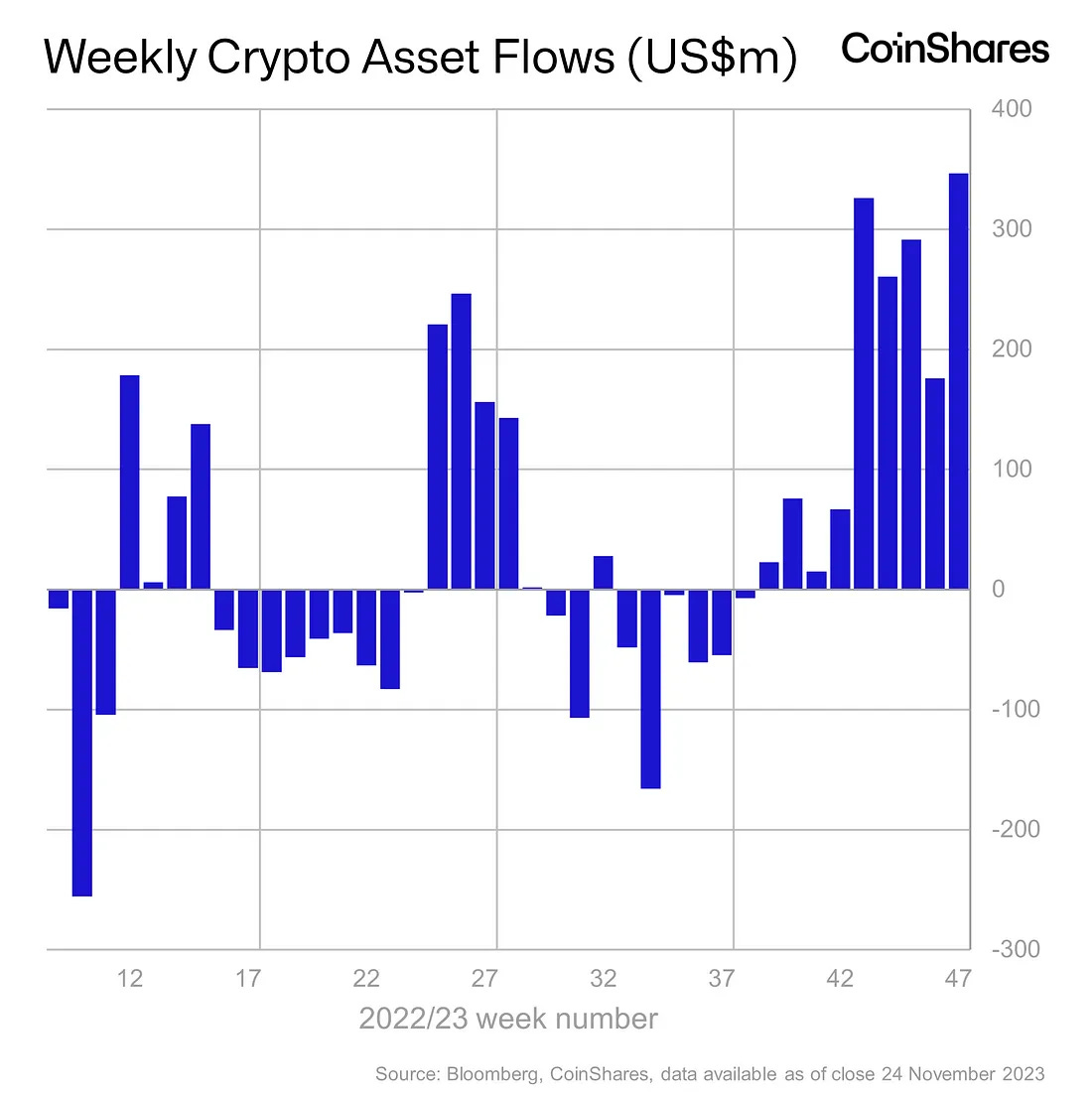

Two long-term bullish signals are also the fact that the total stablecoin supply is finally increasing again, it went up by more than $2bn in 2 weeks, and the fact that the weekly crypto asset flows have been very positive during the 5 last weeks. We are also seeing $COIN (Coinbase stock) reaching a new ATH for the year at $130.

$ETH remains weak versus BTC (ETHBTC almost retraced the whole ETH ETF candle), as $ETH currently stands at $2030.

Gaming and Metaverse

The strongest category of the week has been gaming and metaverse. Basically, all of these tokens performed on par with BTC during the first push of this ETF-driven pump in October, but woke up in November to be the best-performing narrative of the month.

Among the large caps, $AXS is up +15% this week, its closely related L1 token $RON is up +35%, while $APE is up +14%.

$MANA : +12% / $SAND : +8% / $GALA : +9%. These 3 coins were the leaders of the whole metaverse mania back in November 2021, and they have been suffering a lot since then. They usually have one day of +10% spike and then bleed for days (in risk-on conditions) or for weeks (in risk-off conditions). I would not like to buy these 3, because in a sector where the narrative is way more important than fundamentals (gaming/metaverse), they are very likely to underperform vs shiny new coins, and they are still large in terms of market cap, so the multiples they could return are not so attractive.

Illuvium is probably one of the main crypto games, with the “AAA-tier” ambition. It achieved a significant milestone yesterday because it was added onto the Epic Games Store platform. This has definitely been a very positive catalyst for $ILV which is up +15% this week.

Another beast in the crypto gaming sector has been $SUPER, the token of Superverse (it was Superfarm before). Superverse is a crypto gaming studio co-founded by the Youtuber Elliotrades. He has 600k followers, so that is something one can’t ignore. $SUPER went down -95% from November 2021 to its recent lows, but bounced strongly, and is up +155% this week. I held a bag of $SUPER back from 2022, and saw it bleed slowly, but I did not want to sell, because my thesis was that if the bull run comes back, 600k people would hear about this project…

My thesis was similar for Neo Tokyo, which is the crypto gaming community co-founded by Ellio and Alex Becker, another Youtuber with more than 1M followers. There are 2 NFT collections (Neo Tokyo Citizens and Outer Citizens) related to this project, and one ERC-20 token, $BYTES. All of them pumped a lot from the recent lows in the market. I am satisfied to see that my thesis looks to be correct, because it’s not easy to hold “small” projects in a bear market.

There are other very strong gaming coins this week : $ATLAS (+90%) and $POLIS (+60%) are the two tokens of the Solana game Star Atlas, $SIPHER (+67%) is the token of the Sipher ARPG game, $WILD (+41%) is the token of the Wilder World “massive multiplayer metaverse” (December 21 release catalyst on $WILD).

Also : $BLOK (+30%), $BIGTIME (+22%), $SFUND (+25%).

$600M locked in Blast and $BLUR and $LOOKS pump

I mentioned last week the launch of the Blur-related L2 project Blast, a “L2 with native yield backed by Paradigm”. There has been some controversies surrounding this launch, because it’s been accused of being a kind of pyramid scheme, where referrals make you earn more points, which should mean a bigger $BLAST token airdrop.

Dan Robinson, one of the key researchers in Paradigm, even had to “address this issue” to protect the reputation of the fund :

Anyway, in terms of TVL, the launch of Blast has been a total success, because it has attracted more than $600M in a week. These funds are locked until February 2024, but you can earn Lido yield on the ETH you put there, and also Blast points… I don’t think it is really worth it in terms of APR to deposit ETH there, because the TVL is already so high, and your tokens are locked + you take a smart contract risk.

As a liquid token closely related to Blast (read last week edition of the NL), $BLUR has been performing very well this week, because it almost 2x’d in a few days, but retraced some of the gains (-24% from the local top).

$LOOKS, which is the token of the LooksRare NFT platform, has also performed well during this $BLUR pump, maybe because of the beta chasers, but maybe also because they launched their “Infiltration” game.

The alt L1 Sei Network

Among the mid to large caps, the best performer of the week has been $SEI, with +70% gains. Sei Network is a fast alt L1 made for DeFi that is built on Cosmos and was launched in 2023. I went long $SEI on perps at $0.18 because of a few reasons : alt L1 + new coin with price discovery potential + Cosmos has been hot recently + less than $2bn FDV looked small + could be considered as “new Solana” + some smart people started mentioning it.

The UST 2.0 narrative

A very surprising narrative that took off very suddenly this week is the UST 2.0 narrative. $USTC did a 6x in 2 days and is currently sitting at more than 5c, with a +320% pump in 7 days. $LUNC (+65%) and $LUNA (+30%) are naturally up a lot too.

The news that propelled $USTC was the announcement of the launch of a new project called “Mintcash”, and one of its goal is to make a new stablecoin based on locking and burning USTC if I understood correctly. 0xJune wrote a thread on the USTC trade :

I think that $USTC is one of these dead coins that has the potential to do crazy things at some point, with the very clear narrative that it could repeg to $1. We’ve just witnessed such a thing, but I don’t exclude another wave of frenzy about USTC later in this cycle. In the same time, you must know that this coin will bleed as it always does when there is no attention on it…

New coins gud ?

The new “Oracle on Solana” coin $PYTH launched a bit more than one week ago, and it printed the usual “dump-consolidation-pump” post-airdrop pattern, but this happened rather quickly, way more than $TIA for example. I think it could push further from here, depending on $SOL performance too. Here is the $PYTH bullish thesis by Degentrading :

Another new coin is $FLIP, the token of Chainflip, which is a very similar project to Thorchain ($RUNE), whose goal is to enable native cross-chain swaps. $FLIP went from $2 to $7, and is now back to $5.

Finally, the last well-performing new coin is $VRTX, the token of the perp DEX protocol Vertex on Arbitrum. It is up 2X in one week and has impressive volume on the platform, which is suspected to be wash trading by a lot of people on CT. Bull case for $VRTX by Degentrading below :

What else happened in the altcoin market ?

Among the large caps, $UNI has been, surprisingly, the strongest performer of the week. This comes after a full year of severe underperformance of $UNI vs $BTC. Despite Uniswap being the main DEX on Ethereum by far, its token remains a “worthless governance token” that does not accrue value. I don’t know exactly why $UNI has had +17% gains this week, but one of the reasons could be the $4bn fine against Binance, which further consolidates the CEX → DEX potential rotation (as in “perp and spot DEX market share should increase versus CEX”).

$STX has been underperforming $BTC during most of this ETF-driven pump, but during the last 2 days it finally showed signs of strength, it is up +20% in a day and +27% over a week. $ALEX, another “BTC-fi” project, is up +40% this week. $ORDI, the best-performing BTC beta coin, is flat this week.

All eyes are on $DYDX for its December 1st massive unlock. Will it be a bullish unlock like what we saw recently with $BLUR ? Will they announce positive news on the unlock day ?

$SOL, $INJ, $RUNE, have been altcoin leaders of the pump during more than 3 weeks, but then stabilized versus $BTC. They are showing some strength again in the last days, which is rather bullish in my opinion for altcoins.

It has been rumored that Su Zhu is out of its Singapore jail, which is why $OX pumped and dumped today.

$ATOR strongly rebounded from its bottom post-Tor FUD last week, and is up +80% this week.

$ETHW, the PoW-ETH, is up 2x this week, which is the type of things you’d expect from “up only” market conditions, where people are looking for the next narrative to pump.

$GROK, the current leader of the memecoin land, managed to get to a new ATH after its -80% dump. That is impressive strength, but I still don’t like this memecoin and don’t want to buy it. We can also mention the new $FROGE, currently standing at $20M market cap after a strong week.

Friendtech capitulation going on ? Breakdown of the current state by Luke Martin :

Some good tweets / threads :

The CZ thing is very bullish :

Game theory around the ETF :

The DYDX unlock :

Big dips are for buying :

Different valuation ranges for different categories :

What happens on alts if BTC stalls :

Leading indicators of sentiment :

$BTC thoughts by DonAlt :

Optimism is back on the timeline :

Tnut watchlist :

Bullish on $MEME ?

Building positions in an uptrend guide :

Thank you for reading this article,

Cheers,

Viktor.

P.S. : If you liked this recap of the crypto narratives of the week, I would be pleased if you could share it to some friends that could be interested too ! I've enabled Substack referrals, so you can use your referral link, and if you refer people, you are entitled to rewards (USDC). See the leaderboard here.

Can I ask what perp dex you are using to long $SEI?