Narratives of the week : October 20

ETF fake news, $BTC and its beta tokens outperform, $SOL is strong

Welcome to this weekly recap, I am Viktor and you can find me here on Twitter and here on Telegram. Enjoy your reading !

$BTC shows strength after a spot ETF approval fake news

This week was great for $BTC : it is up more than +10%, and is among the best performers in the top 100 coins, which is rare during a green week. $BTC is currently at $29500 and it touched the $30K mark today. $ETH is up +4% and its price is $1600. BTC.D is now at 52.50%, at it highest level this year.

One thing that can explain this outperformance is the fact that there was a fake BTC ETF approval news posted on the CoinTelegraph Twitter account. All the market instantly ripped, and $BTC went up +7% in around 6 minutes. Then people realized that there was no official source besides this tweet by CoinTelegraph, so the whole move up started to retrace and then retraced completely when it was confirmed that it was fake news.

But with that pump, many people realized that the BTC spot ETF approval was coming, and very soon, and that they were probably under-allocated to $BTC. $BTC had a new bullish impulse today, and it basically outperformed most altcoins this week.

I think it makes sense to be long $BTC until the ETF approval, but :

It is likely that the approval only happens in 2024, so lots of things could happen during these few months, and I would be more comfortable bidding <$26k to play this event. The r/r of opening a trade is decreasing while $BTC goes up.

The safest thing to do in my opinion is to long $BTC while hedging with shorts on selected altcoins. My favorite target for shorts are high FDV altcoins that are either overvalued zombies (imo) or have low float : $ADA $XLM $WLD $APT $DOT $XRP $SUI

If the ETF is denied, we are going to see a hellish red candle !

The question remains of what happens after the ETF is approved. Unless for some reason there is a rumor that the ETF will be approved on a certain date and all the market gets convinced that it is going to happen at that moment, then we will 100% get a huge green candle during the few minutes after the news. And then ? High likelihood that it is a local top, because the catalyst will be behind us, and no actual meaningful flow will come right after the approval day.

What happened in the altcoin market ?

Solana, the best-performing major of the week

$SOL is the best performer of the week among large caps, with +26% gains.

I explained in a previous article why $SOL is one of my biggest altcoin bags, and why its fundamentals are very strong in my opinion. In the same time, $SOL is one the most shorted majors, because we know that Galaxy has to liquidate the liquid $SOL tokens of FTX, which means that a lot of selling pressure is coming.

But when the market goes up, the SOL short sellers that get squeezed have to re-buy higher, which offers more fuel to pump, and is one of the reasons for the outperformance of the week. You should also note that each time the market has gone up in 2023, $SOL tended to outperform BTC. It has been a great levered beta this year.

If you are interested in knowing more about the FTX liquidation regarding $SOL tokens, I recommend you to read again DeFiSquared long-form tweet about it. He also tweeted about it more cryptically a few days ago (read below). As far as I understand it, he remains bearish on SOL because of the selling pressure. Thiccy and Jordi Alexander also stated that they were bearish on the short to medium term on $SOL for the same reasons.

Another thing to have in mind with regards to Solana is that their annual conference, Solana Breakpoint, takes place from October 30 to November 3 in Amsterdam. This type of event usually acts as a bullish catalyst for the token.

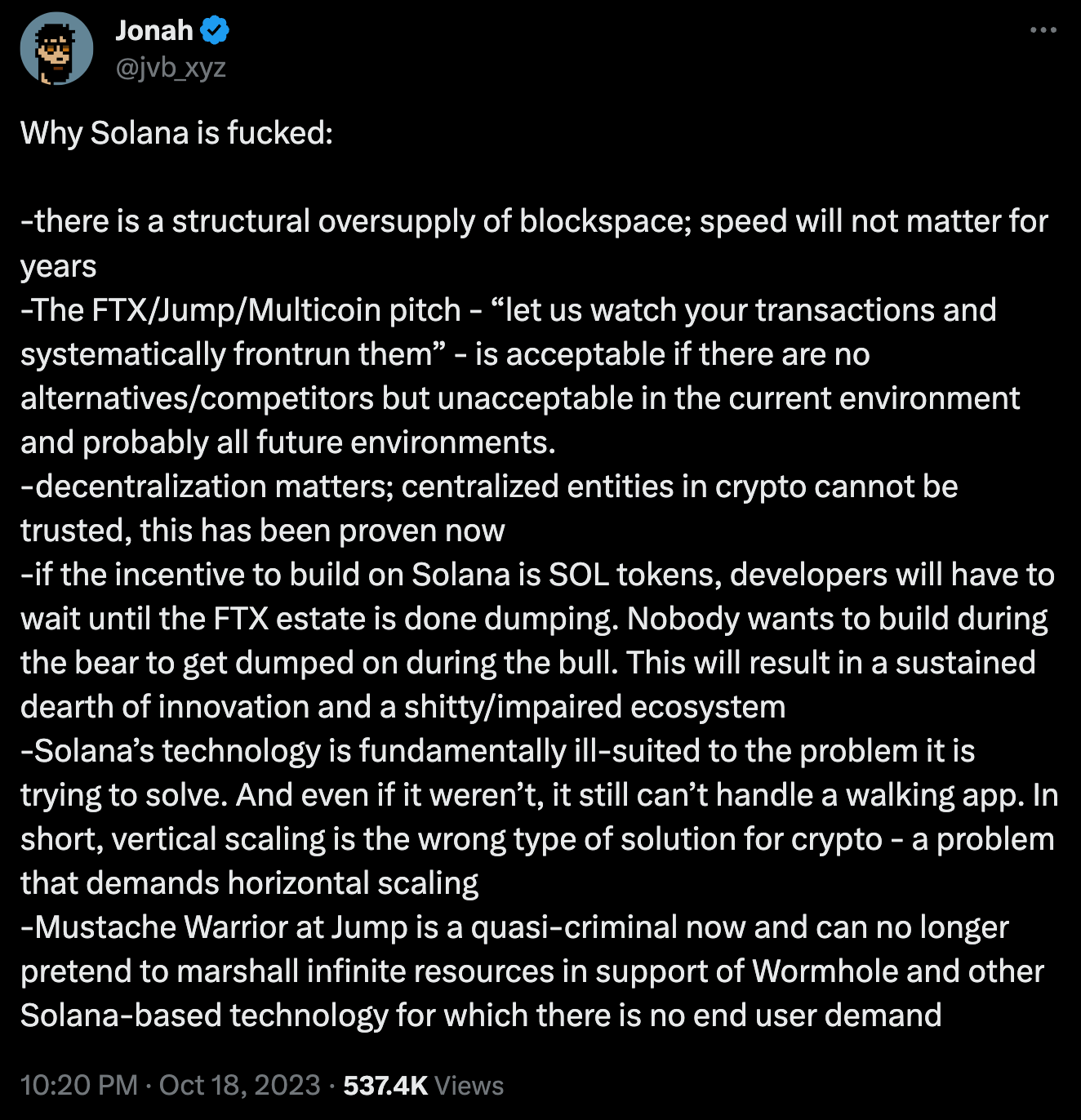

I will also add below a tweet by the trader Jonah van Bourg that was incendiary towards Solana and caused a lot of debate between bulls and bears. Make up your own mind !

BTC high-beta coins outperformed

Besides SOL, the main other outperformers of the week are the coins that are the most closely related to BTC : $STX, $BCH, $BSV. Does it make sense ? Not really, but this is how the crypto market works. These coins are definitely considered as high-beta to BTC, and are likely to perform well if BTC.d goes up in the same time as BTC. During the fake ETF news, $BTC went up +7% in 6 minutes, while $STX did +11.8% and $BCH did +8.3%.

If I wanted to play this BTC-beta narrative, I would probably choose $STX as my horse of choice to do it. PC explains the thesis in the tweet below, and MJ (a good narrative trader that usually has several-week/month timeframes for his trades) is long $STX too.

The Uniswap fake “fee switch”

Hayden Adams, the founder of Uniswap, announced this week that they were adding a 0.15% fee on the swaps that were going to be done on their frontend (ie the official Uniswap website). Not every type of token of swap is concerned. This new "interface fee" is aimed at sustainably funding Uniswap Labs' operations and is distinct from Uniswap's existing "protocol fee" managed by governance voters… which is why the market saw this as a bearish signal, and the $UNI token dropped -6% following the news. The new fee does not benefit the $UNI token holders, and as long as there is no fee switch, $UNI remains a potentially worthless token.

Other altcoin news :

The SEC dropped charges against Ripple’s executives Brad Garlinghouse and Chris Larsen. This appeared yesterday in the news and it is why the $XRP token is up +7% this week. $XLM is usually acting similarly as $XRP and it also pumped on the news.

$INJ (+17%) and $RNDR (+11%) are two of the best performing tokens of 2023 in the top 100 coins, and they did very well this week too. Winners remain winners.

$SUI (-8%) is one of the worst performers of the large cap tokens, because of South Korean Financial Supervisory Service director's statement on inspecting potential supply manipulation by the Sui team. The Sui Foundation refuted any misconduct in a tweet. The second main Move-based blockchain, Aptos, was “offline” during a few hours yesterday. They published a report about it.

$BLUR (+16%) had an unexpected (and unexplained ?) brutal pump this week, followed by a quick dump but it is still up 2-digit gains this week.

It looks like “Polygon 2.0” is coming soon, with the $MATIC → $POL token migration / rebranding. Bybit announced that $POL would be their next LaunchPool project, with October 25 as starting date. Huma Capital noticed it, and wrote a short bullish thesis (he is long) :

$TRB and $BLZ, two tokens that are “cartel coins”, are both up around +50% this week.

Last week, I wrote that I was short $BIGTIME from $0.28. The dump happened even quicker than I expected. Currently it is around $0.14. I took profit close to $0.20 and re-entered a smaller short around $0.17, and I am ready to add if it pumps. Other recent Binance listings include $LOOM (it experienced a massive pump-and-dump, up 10x in a month before a -75% drawdown) and $ORBS (similar but dampened price action compared to LOOM).

Reddit announced this week that they planned to sunset their blockchain-based reward service Community Points, and the 2 main memecoins related to the Reddit ecosystem and community took a hard hit : -86% for $MOON and -50% for $BRICK.

On-chain land :

As usual when the market turns bullish, the biggest gains of the week come from coins that are purely on-chain and that are often memecoins.

$RLB is up +28% over 7 days and remains one of the fastest horses. $UNIBOT is up +19% this week while $BANANA is up +30% from its recent bottom. With similar FDVs, BANANA currently offers 40% APR in $ETH, compared to way less for $UNIBOT, that remains “the Telegram bot of the people”. $PAAL, another Telegram bot (and AI) project, breaks new ATH with +80% gains.

$OX, the token of the OPNX exchange founded by 3AC co-founders, is up around 2X, after a massive drawdown amplified by Su Zhu arrest in Singapore.

The recent king of memecoins $BITCOIN is up +60% this week. It remains one of the memecoins I have the most conviction on for the long-term, especially because some of the new successful tokens are in the same “degen/psychedelic/cultish” meta. An example of this is $MOG, up +80%. Another example is $SPX (SPX6900), up around 2x this week and in price discovery.

Another memecoin winner of the week is $JOE, close to $5M market cap right now, launched a week ago, and it went up 50X in a few days. There is also $REKT that launched yesterday and that has been shilled by Arthur Hayes, which explains why it is already at $15M market cap.

Some (mostly “shitcoin”) tickers I’ve seen a few times on Twitter this week : $WAND, $BLOX, $KINGDOM, $VEGAS, $ZAPEX. Most of them will probably go to zero but if you like shitcoining, that list could be useful.

Thank you for reading this article,

Cheers,

Viktor.

P.S. : If you liked this recap of the crypto narratives of the week, I would be pleased if you could share it to some friends that could be interested too ! I've enabled Substack referrals, so you can use your referral link, and if you refer people, you are entitled to rewards (USDC). See the leaderboard here.

Thanks Viktor!

Regarding ETF news, I see a lot of confusion on timeline but ETF approved does NOT = ETF launch. As you said, if the approval date is mentioned beforehand, people will prob buy in advance and sell on the date. However, I believe it will come out of nowhere, price might pump for a couple hours or days and then dump until it actually launches.