7 crypto narratives for the next bull run

How I want to be positioned to maximise profit with reasonable risk

Ref link shill : My favorite exchange is Bybit, it is where I take most of my perp trades. If you want to start trading there, you can use my referral link by clicking here or use my code AOZDLZ6

What are the potential main narratives of the next bull cycle ? How can you position yourself to make the most of it ?

I procrastinated before writing this article, but it will allow me to present my key investments and how they fit into my perception of the narratives that have potential for the next cycle.

To begin with, I have deployed around 80% of my stables/USD into the market. I've stated a few times since March that I believed the bottom had been reached. Given this, it seemed rational from a risk/reward perspective to have significant exposure to the market.

And when I say “the market”, it means BTC or ETH. I am convinced that $ETH will outperform $BTC (because it is 2.5X smaller, it now offers a great low-risk yield, and is the base for most of the innovations and activity in crypto), so I own way more ETH than BTC. $ETH represent more than half of my crypto portfolio (excluding stables).

My second main holding is $BTC because I still want to be exposed to the current king of crypto, and BTC is the reason we’re all there trading magic internet money.

But this article will be mainly dedicated to altcoins, so let’s dive in :

Besides ETH and BTC, my 3 main bags are currently : $SOL $ARB $LDO. They more or less correspond to the three narratives I most want to be exposed to : L1, L2 (rollups), and LSTs (liquid staking of ETH).

Solana $SOL and the L1 narrative

The main narrative of the last bull run was the L1 trade, with the SOLUNAVAX trio, but also winners like $ADA, $FTM, $EGLD. And even during the previous bull run, they got bid hard ($NEO, $EOS). Notably, there is a substantial premium associated with L1 protocols, and they hold a dominant position in the top 100/200 coins, clearly indicating their significance in the market.

This premium on alt L1 coins, exemplified by the outrageous FDVs of projects like Aptos $APT and Sui $SUI ($5bn to $10bn FDV for less than $50M TVL), is expected to persist, making the L1 trade a compelling proposition even in the next cycle.

This is why I want to still be exposed to this trade, even if there’s now a lot of competition coming from L2s (see next section), and the L1 that I am the most confident in is Solana $SOL.

Solana has managed to gather a real community, and it has the support of a few prominent CT figures that will keep shilling it. There is a lot of activity (daily active users) on the chain, and despite the setback caused by the FTX crash (which might benefit Solana in the long term, nonetheless), Solana has managed to launch new and exciting projects on its chain.

Additionally, $SOL has garnered significant mindshare, often being the natural choice when people refer to a BTC/ETH/XYZ trio. That is maybe the most important thing and a great evidence that it is a good bet.

Furthermore, the huge price retracement from its $260 ATH price (-90% currently) presents an excellent risk-reward opportunity. The potential for a 4X increase from the current price to reach $100 is much easier to envision compared to $8k for ETH (which is also 4x), making $SOL a particularly attractive prospect for substantial growth.

In the L1 category, I also have a bag of $ATOM : that is more or less a cursed coin and my gut feeling says that it will never be a top performer, but it looks very undervalued at $2.5bn MC when you know the considerable size of the Cosmos ecosystem. Unfortunately, the $ATOM token does not seem to benefit so much from the growth of the whole ecosystem. For example, $LUNA, a Cosmos coin, went to $40bn MC while $ATOM remained 5 times smaller at the time. $ATOM seems to not be risky in terms of downside but it might underperform ETH on the upside.

Arbitrum $ARB and the L2 trade

The previous section was dedicated to the L1s, but there’s a consensus that L2 will be a (maybe the) main theme of the next cycle : “L2s are the new L1s”. Just like the L1s, there is a significant premium associated to being a major L2, as you can see on the FDVs of Arbitrum $ARB ($12bn) and Optimism $OP ($7bn).

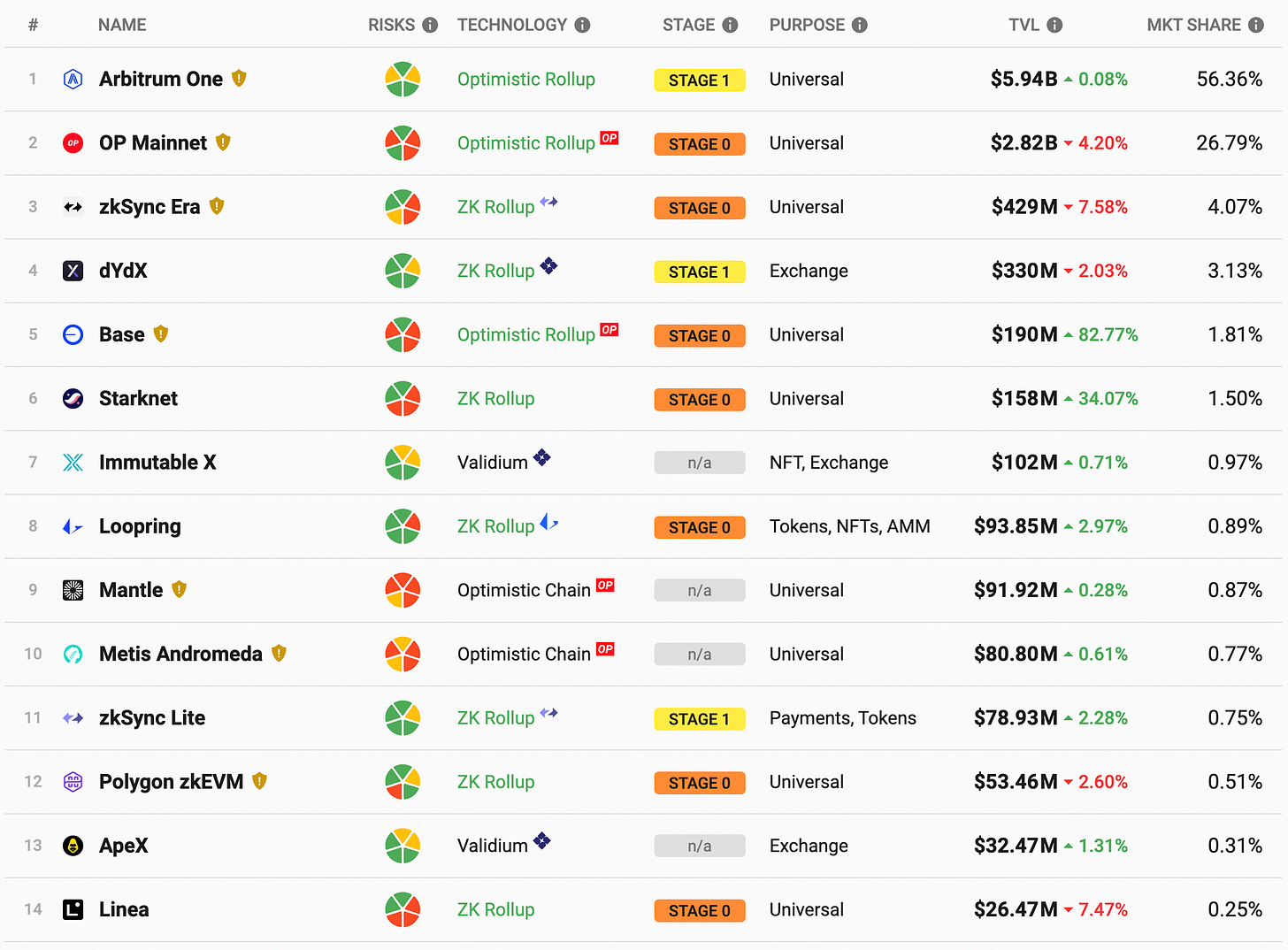

The leaders in the L2 space are by far Arbitrum and Optimism, which are two optimistic rollups, and also the only two major rollups that have tokens. Not a single zk-rollup has reached the activity, adoption or TVL of these two, but I will keep an eye on zkSync, Starknet and Polygon zkEVM.

The EIP-4844 upgrade is supposed to take place at the end of this year, and one of the benefits of this upgrade is to reduce the gas fees on the optimistic rollups. This is a great catalyst for $ARB and $OP that the market is already aware of.

For all of these reasons, I want to take the L2 trade, and because I am already diversified enough in terms of narratives I play, I don’t want to be diversified in that trade, so I have to choose between $ARB and $OP, and my choice is $ARB.

Arbitrum has more daily active users, it has more TVL, it had more daily transactions (until the launch of Worldcoin), it attracts more protocols going multichain and more new protocols, compared to Optimism. In one word, Arbitrum is the most vibrant ecosystem and that is why I want to be exposed to it. I also have the feeling that Arbitrum is the best place to find on-chain gems that can return multiples, and we’ve seen this with $GMX $GRAIL $RDNT $VELA $Y2K for example. I also hold a position in $GMX (see below) and $GRAIL, which make me exposed to Arbitrum growth not only via $ARB.

To be honest, with the launch of Base and Worldcoin that are both built using the OP Stack, and the fact that $OP FDV is around twice smaller than $ARB, I think that holding $OP is an equally good bet compared to $ARB. The “shortcomings” of the two tokens are their high FDVs, but remember that $SOL, $ADA and $BNB all reached FDVs higher than $100M at some point… so considering that the risk associated to $ARB is very low, I think it makes $ARB a good risk-reward bet.

Liquid Staking (LST) narrative : $LDO

The Shanghai update on Ethereum in April finally allowed stakers to withdraw their staked ETH. As I anticipated, there was absolutely no wave of unstaking; in fact, it's quite the opposite: many people are now in the queue to stake their $ETH, with few requesting to unstake them. I believe that Shanghai has ushered in a new era for Ethereum, where LST (liquid staked tokens) will become increasingly important.

Indeed, now that one can more easily move between ETH and liquid staked ETH, the risk of holding staked ETH has been drastically reduced. It makes a lot of sense from a risk/reward perspective to keep your ETH as staked ETH to obtain a passive yield.

The main LSTs available at the moment are : stETH (Lido), rETH (Rocket Pool), cbETH (Coinbase), frxETH (Frax), sETH2 (Stakewise). Lido has been the leader by far for a long time, and I see no reason why this would change : it has mindshare, it is seen as the safest one, it is the most liquid LST, and people are lazy to change their habits.

We have also seen a whole new sector emerge : “LST-fi”, which is basically new DeFi protocols that are based on LSTs, for example Liquity forks that work with stETH as collateral instead of ETH. Lybra and Raft are examples of Liquity forks, but we could also cite Unsheth, Eigenlayer or Pendle in the LST-fi sector.

As long as the TVL of LST and the LST-fi sector grow (which I speculate will happen during the whole 2 years to come), people will want to trade the narrative. The most obvious bet in that case is simply to buy $LDO, because it is the leader.

What’s more, Lido is currently the most closely related protocol to Ethereum and its success, which means that it’s a levered bet on ETH, or a “high beta” altcoin to ETH : it is a way to outperform ETH on the way up, and accumulate more ETH. At least I hope that the market will follow this thesis.

Lastly, $LDO is strong in terms of fundamentals, and the usual financial valuation models can be applied to Lido by predicting what the protocol revenue could look like in a few years. Arthur0x wrote a great “bullish on Lido” article specifically about this, and you can read it here. This means that tradfi will be interested in investing into $LDO, and hopefully we are going to be able to dump on them at the height of the bull run.

Perp DEXes : $GMX, $GNS, and other things

In 2022, in the depth of the bear market, people started to suddenly get interested in a new narrative called “real yield”, which basically meant “invest in protocols that generate actual revenue”. Great idea ! It's also the moment when perpetual decentralized exchanges (perp DEX), which are a category of protocols generating significant fees, started to really capture the market's attention.

The most obvious one is $GMX, the main protocol on Arbitrum, and the second biggest perp dex behind dYdX. You can for example look at the GMX/ETH chart and see that it was extremely strong during the second half of 2022 and until March 2023. Basically GMX did not stop making new higher highs and higher lows against ETH.

The same applies to $GNS (Gains Network), which was initially on Polygon but expanded a few months ago to Arbitrum.

These protocols haven't been making much noise since their all-time high around February 2023, but the perp DEX narrative is a long-term one for me, and I think they are prime candidates to outperform the market.

My 2 main perp DEX positions are GMX and GNS, for the following reasons :

Perp DEXes are cash-cows that generate a lot of fees and revenue, that’s rare in crypto

I can stake them on their platform to get a yield during the bear market

They are two protocols that are not very far from their ATH prices, which means, they should reach new ATH in bull market, and that’s great because the craziest runs happen with price discovery.

Many protocols can be built upon them : this is especially true of GMX, I think at least 10 other protocols are offering services (yield) that depend directly on GMX

It is a category that has proven to be strong, both during this whole bear market, and during the January-February push in the market.

Both of them are on Arbitrum, and betting on them (especially GMX) is a bet on the Arbitrum ecosystem.

I also hold a significant position in :

$LVL : Level Finance, a perp dex protocol on BNB chain that is among the best performers bottom to top in 2023, that generates a lot of fees and deployed on Arbitrum too, but suffered a lot recently.

$KWENTA : perp protocol on Optimism built on top of Synthetix, it provides a good yield and enables me to have some exposure to Optimism, but suffered too in the last weeks.

$DEUS : this is a smaller perp protocol that will become $SYMM, it is an asymmetric bet, but the team suffered different hacks, so I am not ultra-bullish, though in the same time, having a new token with a pristine chart is great.

Lastly, I have some $INJ (Injective). It's not really a perp dex protocol, but rather a Cosmos blockchain focused on financial applications, which means it can accommodate perp dex within its ecosystem. However, one of the main reasons for my investment in $INJ is its strength in 2023, it is a coin that has a lot of momentum, so as the winners tend to keep winning, I simply don’t want to fade this one.

To be honest, the recent months have been hard for perp dex protocols because of the low volatility and as a consequence, low volumes. This is a concern to have in mind, and a second one regarding my $GMX position is that it is currently losing market share in terms of volume. Two reasons for this could be first that the UX is generally bad compared to CEX trading (high fees for users), and second that a lot of new perp DEXes are launching. I will revisit my thesis regularly and assess if I should exit or decrease my position or not.

Memecoins : $PEPE and $BITCOIN

During the last cycle, we have seen $DOGE reach a $70bn market cap, and $SHIB reach a $44bn market cap. In 2023, a new memecoin called $PEPE went from 0 to $1.8bn in around 1 month.

What looks like utter absurdity to any fundamental-driven investor is actually the embodiment of very human and natural behaviors and tendencies. “Funny meme, price goes up” is a very simple left-side-of-the-curve investment thesis. It is nothing else than a meme, it has no instrinsic value, it generates 0 cash-flow ? That’s even greater because there’s no valuation model that can tell you that it is over-valued !

Memecoins are like lottery tickets that are more skewed in your favor (debatable), plus they are funny, and you can celebrate the pumps with your crew. Unlike lottery tickets, they also allow you to experience a lot more excitement. Furthermore, they are highly reflective: the best indicator that the price will rise is that the price has risen so far.

At first, I planned to accumulate $DOGE during the bear market, as a surefire way to outperform $BTC during the bull run, simply because DOGE is Lindy and has lot of mindshare. But I changed my mind after I saw $PEPE do its run. We now have a shiny new memecoin that is already listed on Binance, down -70% from its ATH, and only $600M in market cap. Which is… close to 15 times smaller than $DOGE. I think that PEPE below $500M is a no-brainer, and the likelihood that it does at least a 10X seems way higher than the likelihood that DOGE does a 10X (it would mean DOGE MC = $100bn).

The second memecoin that I hold and that embraces even more the degen spirit of crypto is HarryPotterObamaSonic10Inu, with ticker $BITCOIN. At the time of writing, this memecoin is at around $110M market cap and just had a huge run up, it is a way riskier bet than $PEPE and I am not sure I will hold this one with the same conviction as PEPE, but it is a good candidate to reach at least a few hundred million dollar market cap, or even $1bn.

I can add in this “memecoin” category that I also think that Milady NFTs and the derivatives (Remilio, and the $FUMO ERC-20 token) are going to do well (probably better than most of the “blue-chip” collections of the last cycle, down -75% from their ETH ATH price), as well as Sproto Gremlins, which is the NFT collection related to the $BITCOIN ticker, and that have a very unique identity.

DeFi 1.0 : $AAVE

You might be aware of the famous prediction by DegenSpartan around 3 years ago, that a DeFi bear market of 36 months had started. Looking back at it, the prediction was quite spot on : most DeFi coins are down only versus ETH, either since DeFi summer 2020 (COMP, MKR), or March 2021 (SNX, AAVE, UNI).

We have recently seen signs of life again from these “DeFi 1.0” coins, they have even been among the best-performing coin category for 2 or 3 months.

The token that I like the most in this category is $AAVE : its market cap is only $1bn, and yet it’s by far the 1st money market on Ethereum and on other EVM chains, it generates revenue, it just released its GHO stablecoin… It is a “blue-chip” that has very strong fundamentals and it looks undervalued. I see no reason for its FDV to be 6 times smaller than $UNI’s one for example.

I don’t expect $AAVE to do wonders in terms of multiples, but it could at least keep up with $ETH and even outperform it. If there’s a DeFi 1.0 revival, $AAVE will benefit from it, and if there’s not, at least it is somewhat of a “value-driven” investment in crypto.

The other narratives

I find it challenging to place highly concentrated bets because I like to be exposed to all the narratives that seem to have potential. This is why I end up with a somewhat overly diversified portfolio, which I don't necessarily recommend, especially if you have a small portfolio. Here are the other narratives I'm exposed to:

Gamblefi : $RLB, $DMT

One of the biggest narratives of the last months has been gambling / gamblefi / decentralized casino. The main token is by far $RLB, the token of the Rollbit platform. $RLB is a very “hated” coin because the platform has a shady reputation, but it seems to generate a lot of fees and revenue. The gambling industry is huge, and a company like Stake.com which is an online casino, is an absolute cash machine. The potential of online casino + crypto is high, so I am positioned on $RLB.

I don’t expect to hold that position indefinitely though, as I have stated recently on Twitter : I think $RLB is destined to keep going up a lot in the months to come, and then crash badly after intense FUD at some point. That’s just a gut feeling but it is how I expect it all to unfold. A potential source of FUD would be the fact that several people can’t withdraw from the platform, or Rollbit could have legal problems (that would not be surprising for the gambling industry), or we could discover that some of their metrics are pulled out of thin air.

My second bet in the gamblefi industry is $DMT, the Dream Machine Token of the Sanko Dream Machine platform. I wrote about it in this tweet and here were some of the things I liked about it : it is an Arbitrum coin, the market cap is not so high right now ($25M), it has degen vibes and embraces the meme culture (with Milady for example), and it is close to price discovery.

Telegram trading bots : $UNIBOT

The second huge narrative that emerged recently is the Telegram trading bots. The main one is obviously $UNIBOT, and I simply submitted to the narrative by buying it. When there’s a completely new meta that many people talk about, and there’s one strong leader, that is in price discovery, you often don’t have to think twice : buy the leader, and chill. That is what i did and I am happy about it. Even at the current prices (between $100M-200M market cap), I don’t see a reason to dump my stack, since the token and narrative is so strong, and I could easily see $UNIBOT nearing the $1bn MC mark.

UX/UI is a major problem in crypto, and TG bots are making trading a lot easier and seamless compared to Metamask trading, so the value proposition of these bots is clear, and the revenue they generate is good evidence of a product-market fit.

I own very small positions on other TG bot tokens, and that looks more like active shitcoin trading, I don’t have much conviction in it.

Gaming coins

I believe that crypto gaming is one of the most natural uses for cryptocurrencies, and it seems inevitable to me that this sector will eventually boom. Of course, there was already a big bubble in crypto gaming at the end of the last bull market, especially due to the metaverse hype, and so this sub-sector experienced significant drawdowns during the bear market.

I have the conviction that it will come back, and maybe at this time it will be better to buy the new coins, but I give you my gaming coins “watchlist” anyway : $UOS $PYR $ILV $ENJ $SUPER $SFUND.

Asymmetric bets

My asymmetric bets are wagers on tokens that have a very low valuation, can go to zero but can also easily do a x10 or much more. They correspond to projects that generally have strong fundamentals, but which the market doesn't seem to value properly. I will write a full article dedicated to my asymmetric bets, but I can give you a preliminary list that I already shared a few times on Twitter : $ANGLE $ALU $APW $BYTES $MIMO $JRT.

This article reflects my investment theses and portfolio as of August 2023. However, this may change in the coming months based on market developments.

What is your opinion about the crypto narratives that have the most potential ? Do you agree with my current allocation or not ? Feel free to like this article and leave a comment below !

Thank you for reading it,

Cheers,

Viktor.

Good thread, I have same thought on several positions

Great lecture !