Welcome to this weekly recap, I am Viktor and you can find me here on Twitter and here on Telegram. Enjoy your reading !

$BTC and the market overall :

The week was red overall for the market, with a slow bleed for $BTC that went from $28000 to around $26800. $ETH is even more dumping and is sitting at $1540, a price we’ve last seen in March 2023, while ETHBTC is at 0.058. That weakness from ETHBTC during the last weeks could be explained by the FTX exploiter swapping his ETH for BTC.

There was no clear reason for the market dump, considering the fact that stocks are up this week, despite the situation in Israel. We’re still in the same spot than the last few weeks, where “value buyers” don’t show up because we’re too high, and in the same time the risk/reward for shorting is not very interesting. I’m inclined to think that $BTC will have a final capitulation during Q4 that should be bought from below $25k to $22k, and then we will go up until the spot ETF, that could mark a local top.

One of the ways you could predict that the moderate pump of last week was not “strong”, is that it was clearly perp driven when you look at CVD, while there was no meaningful spot buying. On the contrary, the dump is both spot AND perp driven… when will spot sellers run out of coins ? Despite the dump, open interest remains stable, which is not particularly bullish since funding is positive. (This means roughly that traders still leverage long after each BTC price decrease… so BTC can be squeezed to the downside.)

The altcoin market :

Stars Arena, the main friendtech competitor, on the Avalanche network, has been hacked on October 7 for $3M, which was its entire TVL at the time. Stars Arena was the only FT competitor that actually got traction, and it was very bullish for the $AVAX token, that was having a rough bear market, and went from $9 to more than $11 before the hack. Now it has dumped again close to the $9 territories. Stars Arena first gathered funds to repay users, and then even found an agreement with the hacker to get back most of the stolen $AVAX, but now the momentum has clearly died, and being hacked for the whole TVL just a few weeks after launch is very damageable in terms of reputation. It will be hard for them to get a second life.

$RUNE (Thorchain) was one of the worst performers this week among “large” caps. It was down more than 2-digits percentage-wise, after its more than 2X pump over 2 months. One of the reasons for its initial strength that I did not mention last week is that the FTX exploiter has used Thorswap to swap its ETH for BTC during a few weeks, which made a lot of volume for the Thorswap bridge. But being the main platform used by a hacker to launder (or at least try) his money is not so great, and that’s why Thorswap has been put in maintenance on October 6. This caused a dump all week long, but the coin price rebounded yesterday after they announced that Thorswap was back online. What did they change ? Their terms of service, and they partnered with a chain analysis firm that will probably prevent illicit funds from going through Thorswap. The FTX exploiter tried to use another similar service, Threshold (the ticker of the token is $T), to swap his ETH into native BTC, and this probably the reason for the pump of $T.

This week, the trader Thiccy posted a tweet about the rumor that Parity, the firm that is behind the Polkadot Network, has laid off over 300 employees this week. Parity denied it, and stated that they were simply transitioning to decentralized teams (read the Block article about it here). In the weeks to come, a few hundred million dollars worth of $DOT token used for crowdloans are going to be unlocked. These news are a good illustration of the challenging situation in which a good portion of alt L1s currently find themselves, struggling to maintain an optimistic outlook in a context where even the activity on Ethereum is extremely reduced (the gwei is often worth less than 10 at the moment).

Worldcoin token $WLD has bounced a few times on its $1.5 support, but now the breakdown has happened and the current price is $1.47. My $WLD short is in profit again but I don’t plan to close it before at least the $1.25-$1.3 region, ideally close to $1 depending on market conditions.

$INJ is one of the rare coins that started the year with a lot of strength, and that did not give up much of its gains, its drawdown vs BTC this year is minimal. $INJ feels like a very comfortable hold, probably among the best Cosmos coins.

Another strong Cosmos coin this week has been $KUJI (Kujira), it is up +24%. Kujira is a whole ecosystem that seems to have a suite of different products. They were on Luna initially but successfully managed to launch their own chain.

$FXS is among the best performers in the top 100 coins. The catalyst for this is probably the launch of $sFRAX yesterday, which is a staked version of their $FRAX stablecoin, but that earns yield (on-chain T-bills yield). $FXS is now one of the main tokens of the “RWA narrative”, alongside $MKR.

A new token dropped this week : $BIGTIME. The ticker is a bit odd, but it is simply the token of the crypto game “Big Time”. I have been hearing about this game for a long time (it goes back to the 2021 bull), and I think it has strong fundamentals. I think that Big Time is similar to Illuvium, with the ambition to be close to an AAA game.

The token was launched on October 11, and did close to +400% in 2 days. There is a serious lack of transparency about the tokenomics, but we know that the current FDV is around $1.2bn, and the market cap is way smaller, around $40M according to CoinMarketCap. Considering the fact that $AXS has a FDV of $1.1bn and that it is the biggest “crypto gaming” coin, I am of the opinion that $BIGTIME is overvalued and its price will be lower in the weeks to come. But I also think this coin will be highly volatile, and it can still pump higher in the days to come. I am short with an average entry price of $0.28.

Votes are currently going on for the distribution of Arbitrum grants. Dopex, the options platform on Arbitrum, is currently one of the projects with the most support, which explains the good performance of $RDPX this week (+32%). $LODE and $JONES are two other Arbitrum coins with 2-digit gains this week.

Two tokens have been able to pull new all time highs this week, namely $ATOR and $HILO. ATOR is a privacy project that is meant to empower the adoption and strength of the Tor network, by rewarding users that contribute to Tor. HILO is a crypto predictions platform, where you can both make crypto price predictions or real life predictions (sport betting for example). Crypto Cevo shills both of them, and it is a good idea to follow the tokens that he likes, since he has a lot of followers and they trust him.

The “onchain summer” coins are all down bad from their ATH, besides $RLB that resists quite well to the dump (only down -40% from its top) thanks to its huge revenue and fees. In terms of P/E, $RLB is undervalued compared to other altcoins, but I think that the legal risk implies that there will always be a discount on Rollbit token. $UNIBOT is now down below $50, and for me it gets interesting in the $20-$40 range to re-accumulate some. $BANANA is below $6, it is probably good in terms of risk-reward too. The same is true for $BITCOIN (hpos10i), that is in my opinion a good buy around here, but it might keep bleeding for some time.

Some good tweets / threads :

On confluence (click to read the whole tweet) :

Market thoughts by ChiefingZa :

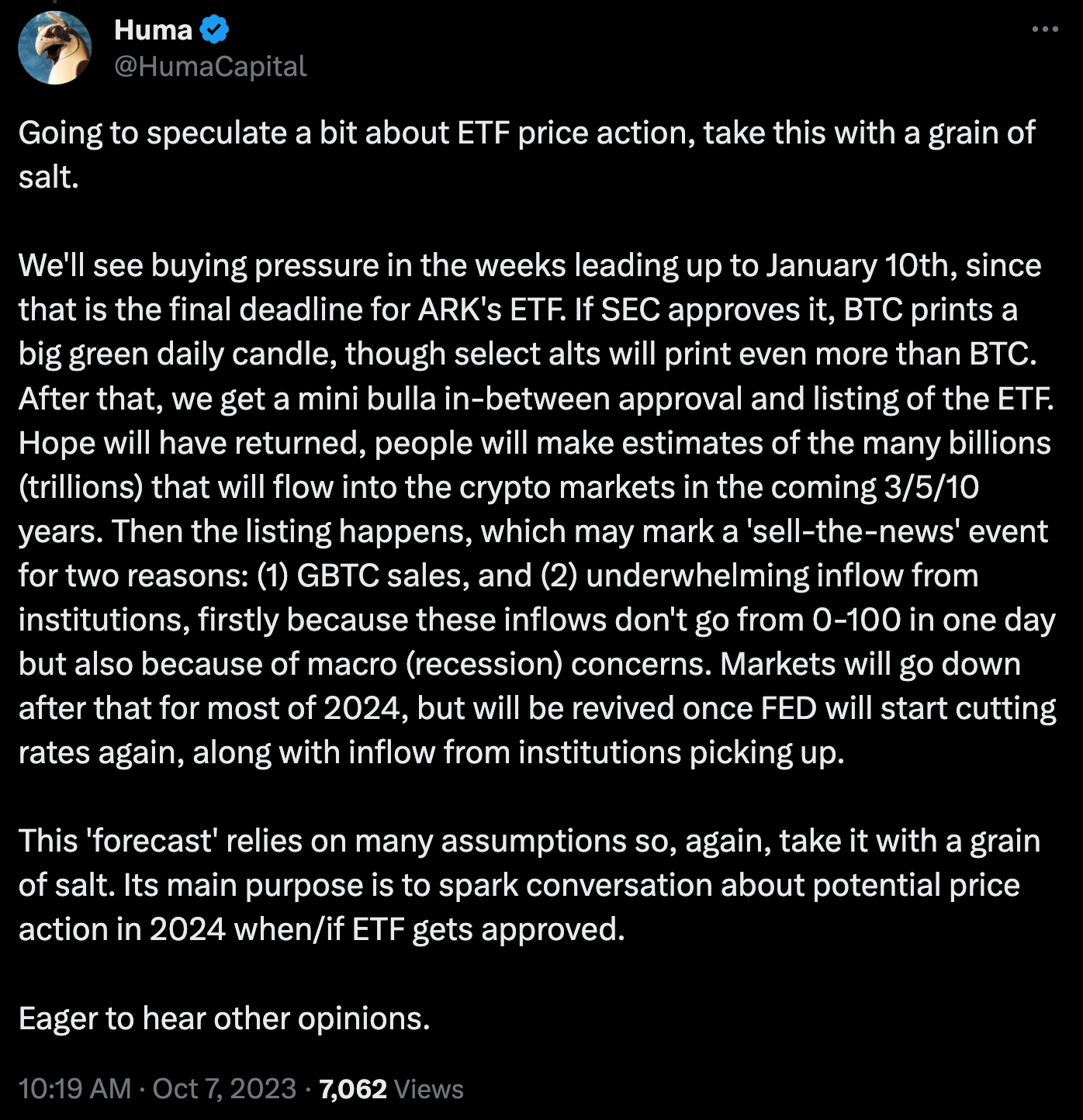

Market speculation by Huma :

Few things Runner wishes he knew (click to read the whole tweet) :

About the lifecycle of the “100x gems” (click to read the whole tweet) :

List of free orderflow tools :

Old school DonAlt tweet because why not :

Cheat sheet thread on OI and CVD (click to read the whole thread) :

Bullish ?

List of dominant category leaders in crypto (click to read the whole tweet) :

Thank you for reading this article,

Cheers,

Viktor.

P.S. : If you liked this recap of the crypto narratives of the week, I would be pleased if you could share it to some friends that could be interested too ! I've enabled Substack referrals, so you can use your referral link, and if you refer people, you are entitled to rewards (USDC). See the leaderboard here.

solid brotha