Narratives of the week : March 10

$BTC new ATH, liquidation event, AI / memes / gaming are hot

Welcome to this weekly recap, I am Viktor and you can find me here on Twitter and here on Telegram. Enjoy your reading !

Ref link shill : My favorite exchange is Bybit, it is where I take most of my perp trades. If you want to start trading there, you can use my referral link by clicking here or use my code 6Y2XOR

$BTC and the market overall

Each week for the past few weeks, $BTC has been heading to new highs, and it was the case once again this time. $BTC jumped from $62k to $69k in one day. It crossed its previous ATH of $69k on March 5, started to breakout vertically during literally one minute, before being violently rejected down to $67k in a few minutes. This marked the beginning of a few cascades of long liquidations, that culminated a few hours later when $BTC wicked to $59k (-15% total drawdown), while some altcoins went down as much as -20% or -30% or even more.

It has been one of the largest liquidation events in a few months and even years, and it is quite healthy for the market since the funding rates were getting insanely elevated. It was a great dip to buy because the price was back at $67k one day later. In this current environment, which should still only be the ‘beginning’ of the bull run if the 2020-2021 playbook runs again, buying liquidation cascades and -10% dips is a great opportunity. Your only goal is to survive and not get liquidated, so don’t take stupid leverage. It is incredibly risky to be highly leveraged, and having longs liquidated in a bull run is just so dumb.

Three days later, $BTC was back at $69k and trying to break out again. This time it reached $70k but was once again rejected back to $66k. And right as I write these words, $BTC is approaching $70k again. We can feel that the market is horny, and it seems obvious to me that $BTC is going to be at $75k or $80k in a few days or weeks.

$ETH has been able to keep up with $BTC this week, which is in my opinion very bullish for $ETH. ETH does not have ETF inflows, contrarily to $BTC, and BTC tends to be the outperformer when it get close to its breakout, so the fact that ETHBTC does not decrease is good for ETH medium term. $ETH reached $4k this week. It was almost 2x lower at the beginning of February.

If the market behaves in the same manner as during the previous bull run, BTC should outperform after its $70k breakout and BTC.D should go up, but I still think that $ETH presents a better risk-reward for long now. The decisive factor will be whether an $ETH ETF will be approved or not.

As I’ve stated a few times, my portfolio has been 100% allocated and exposed to the market for a few months, and I still believe that the biggest risk right now is being under-allocated or cutting your long positions too quickly. Even if the market completely ripped over the last 6 weeks, I think that if I was sidelined right now I would invest a large chunk of my portfolio and then add aggressively during each dip. (This is precisely because ‘max pain’ for me is missing the upside, while for other people, they suffer more from a drawdown. Know what kind of trader/investor you are.)

Memecoins

Last week, I mentioned that memecoins were the best-performing category, and it is true again this week. The bulk of the memecoin run lasted from February 26 to March 5 (9 days), but they did not even selloff that much from their highs, and seem to be mostly consolidating.

Over the last 7 days, we’ve seen these gains :

$PEPE : +120%

$FLOKI : +95%

$SHIB : +73%

$WIF : +55%

$BONK : +50%

$DOGE : +35%

$MYRO : +200%

Other smaller memecoins worth mentioning would be : $MOG, $WEN, $MAGA (TRUMP), $BITCOIN, $TOSHI, $DOG, $LADYS. I have been very impressed by $SHIB performance, because it almost performed on par with some of the new smaller memecoins, while being a $20bn behemoth. $SHIB has been able to go from $13bn to almost $26bn market cap in less than 2 days.

But at this moment, a clean pair trade appeared, which consisted of longing DOGE to short SHIB, with the thesis that SHIB would not flip DOGE in market cap on any meaningful timeframe :

At the time of writing, the total market cap of memecoins is around $56bn, which corresponds to 4% of $BTC market cap. I expect this ratio to continue to go up during the bull run.

My plan on memecoins is basically to hold my longs without trying to trade them and time them. If you feel sidelined on memecoins, maybe the best strategy is to either accumulate slowly now that they are consolidating, or simply trade their breakout and hold the positions once you caught them.

AI coins

I have the feeling of writing the same piece each week, but AI coins are once again among the best performers this week. The main catalyst did not change, it is Nvidia GTC 24 conference on March 18, but I think people would find any excuse to long AI coins, and this conference is just one among others.

Some of the top performers have been $GPT/$LAI (+200%), $PAAL (+100%), $PHB (+90%), $AGI (+80%). But even the large caps that are on CEX had very impressive returns : $FET (+70%), $RNDR (+56% ⇒ this is the most direct Nvidia beta and it is now the largest AI coin), $AGIX (+53%), $OCEAN (+37%). $NEAR is the only major alt L1 that can be considered as an AI beta too, which is a huge advantage for its price.

Even $WLD had a pump again, but this can be explained by their contract term change :

The current total market cap of AI coins is somewhere around $30bn, and this represents 2% of $BTC market cap. This is also a ratio that I expect to increase massively over the bull run. Memecoins and AI are probably going to be the narratives that outperform the most.

Gaming and metaverse

The third main rotation of the week has been into gaming, and it started yesterday. Top-performers have been :

$GALA : +80% (in 7 days)

$YGG : +55%

$PIXEL : +70% ⇒ A new coin that did not have its run yet is a good Schelling point when you see that the gaming narrative is heating

$SLP : +66% (Axie ecosystem dark horse ?)

$WILD : +125%

$MAVIA : +55%

$GF : +60%

$GF and $YGG are both gaming guilds, just as $MC, and $MC has become a gaming behemoth since its migration to $BEAM, which is why there could be a similar catchup play going on on $GF and $YGG.

The current market cap of the whole gaming sector is around $20bn, ie 1.5% of $BTC market cap. This will increase a lot too. The total FDV of gaming is higher though, around $50bn.

Alt L1s

A few alt L1s did really well this week. As mentioned before, the first one is $NEAR, because it is the only major L1 that benefits from the AI bid.

The second one is $FTM, which is up +55% this week. $FTM is one of the large alt L1 from the last cycle that has been completely beaten down during this bear market, especially with the Multichain hack and the depeg of all their stablecoins. But they have a major upgrade coming soon and called Sonic, and Andre Cronje, the main face of Fantom, seems to still be working on it with efforts.

Another one is $CRO, which is up +46% from the beginning of the month. $CRO is both the “CEX token” of Crypto.com and the gas token of the Cronos Chain. CRO picotop also marked the top of the crypto market in November 2021, and CRO could be a good way to gauge retail engagement, since Crypto.com is very retail-friendly.

$SOL had a good week too, with +14% gains. It was announced that Pantera (a crypto fund) was raising funds to buy locked $SOL from FTX at a discounted price.

Two of the most direct Solana beta coin, Jupiter (dex aggregator but also most used dapp on Solana) and Neon (the EVM based on Solana) both outperformed the market : +35% for $JUP and +27% for $NEON. $JUP is now almost in price discovery, after a slow start.

$BNB is also exceptionally strong with +30% gains this week.

What else happened in the altcoin market ?

$W (Wormhole) announced their airdrop this week, and people can now see if they are eligible to the airdrop (you can’t claim yet, though). The current valuation of $W in pre-markets on Aevo is $16bn FDV. As I mentioned in a previous edition, with the high FDVs that $W and $ZRO (LayerZero) are probably going to have, most bridge coins look a bit undervalued, and there could be a catchup play here. $SYN (Synapse) and $ACX (Across), two bridge coins, are both up +45% this week. $AXL is up +120% in a month.

Surprisingly, even if the Dencun upgrade (EIP-4844) is supposed to happen this week (March 13), most ETH beta coins did not perform particularly well, and in fact most of them even underperformed. The two ETH beta coins that had the best gains this week are the two most recent L2s : $MANTA (+25%), and $STRK (+33%).

$ONDO, the main RWA coin, is up +20% this week, and slowly continues its price discovery. Its market cap is still below $1bn.

The funding rates remain very elevated across the board, which implies that Ethena, the protocol that handles a stablecoin (USDe) that runs the ETH basis trade, has a very good yield (+65% this week). This implies that people will want to buy $USDe, and they can do so without selling their volatile assets by borrowing stablecoins against them, and swapping these stables against USDe. This means that the yields in DeFi to borrow stablecoins are going to increase a lot, so the revenue of all the DeFi lending protocols will go up (Maker, Aave, Curve, Frax). Long the lending protocols ? $MKR is up +22% in two days, after the announcement that the DAI savings rate would be increased to 15% (from 6% iirc), because of the bullish market conditions.

$RUNE, another lending protocol (it is way more than this, I know), is up a massive +50% this week. They burned this week 60M $RUNE, and increased the lending caps for $BTC and $ETH. You might remember that $RUNE was one of the hottest coins in Q3 2024, and it can be seen as a $BTC beta coin.

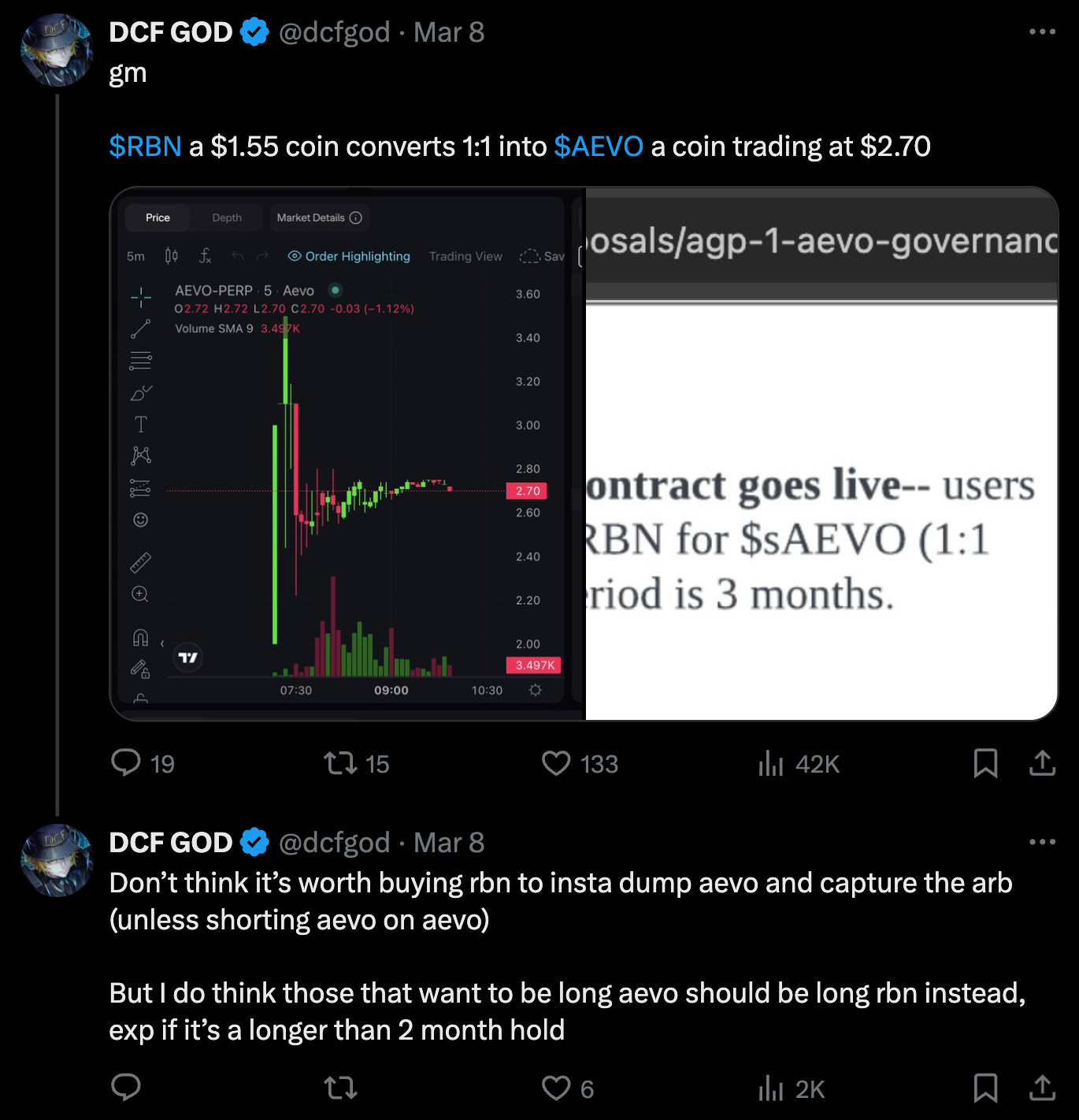

$RBN is up +115% this week, people are longing it based on the fact that it will be migrated to $AEVO 1:1 (or staked/locked AEVO or something), and AEVO is valued higher OTC.

It was announced this week that Do Kwon would be extradited to South Korea instead of the US, which was interpreted positively by the market because $LUNA, $LUNC, and $USTC did all pump after the news. The rationale behind it is that justice in South Korea will probably be less harsh than in he US ?

Thank you for reading this article,

Cheers,

Viktor.

Ref link shill : My favorite exchange is Bybit, it is where I take most of my perp trades. If you want to start trading there, you can use my referral link by clicking here or use my code 6Y2XOR

Fantastic article! Would you be able to share how you obtained the approximate total market cap numbers for AI coins and Meme coins? I find them very useful.