Welcome to this weekly recap, I am Viktor and you can find me here on Twitter and here on Telegram. Enjoy your reading !

Ref link shill :

My favorite exchange is Bybit, it is where I take most of my perp trades. If you want to start trading there, you can use my referral link by clicking here or use my code 6Y2XOR

If you prefer to trade on a decentralized avenue, you can go to Aevo which has been very responsive to new launches as it even enables trading of pre-launch tokens (JUP, DYM, BLAST…) : https://app.aevo.xyz/r/VIKTOR

$BTC and the market overall

This week was more or less up only for $BTC, which went from $43k to almost $52k. In the usual crypto style, $BTC did not give any comfortable entry to the sideliners, because there was barely any dip during this move.

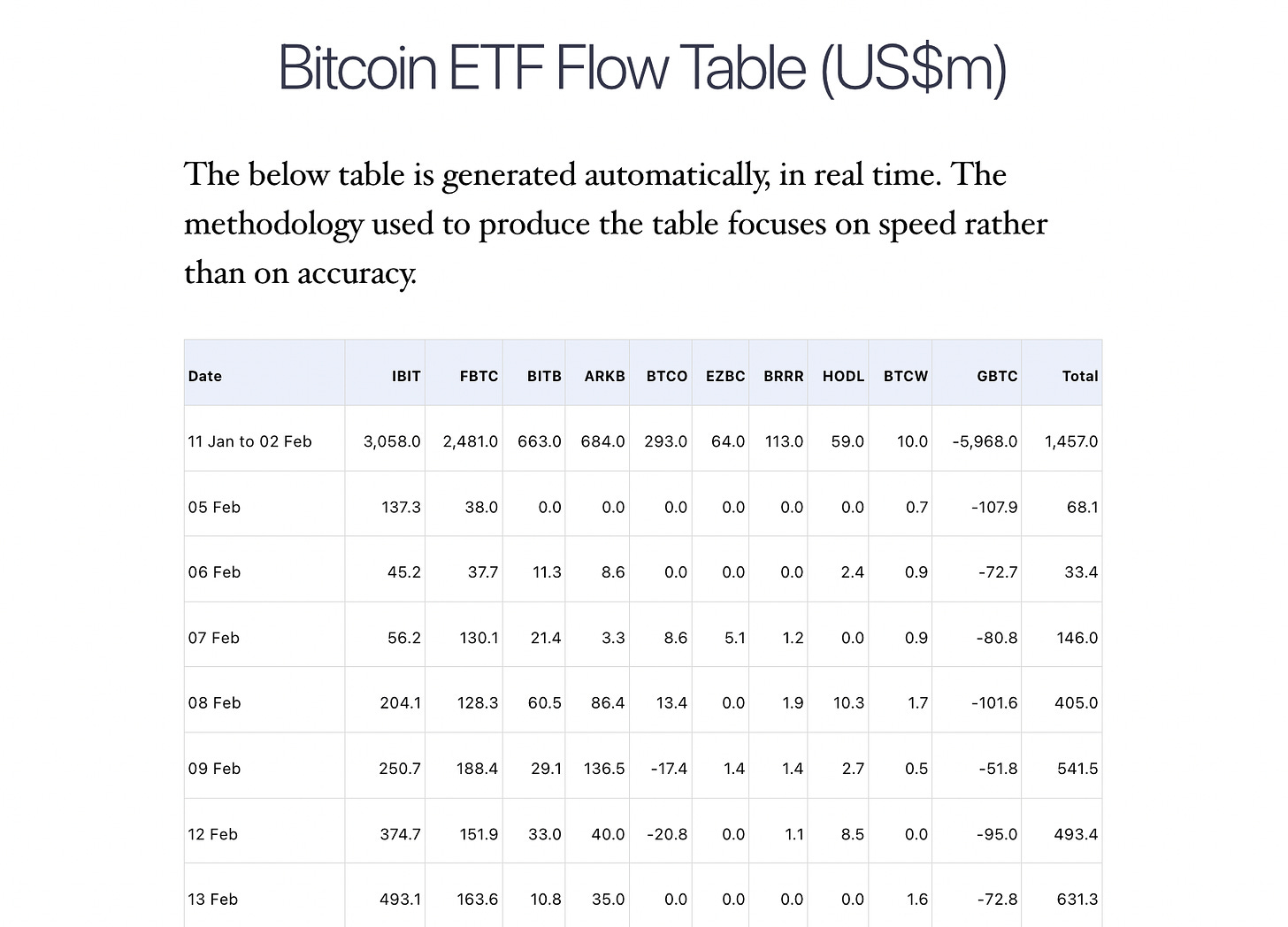

The main two reasons for this performance are probably the fact that tradfi is strong and in price discovery, and also that the ETF flows are really bullish. While the first trading days were very much a transfer from GBTC to the new ETFs, and everyone was focused on the “massive” GBTC outflows, now we are seeing that inflows are consistently higher, and we are at an average size of $500M net flows into the $BTC ETF daily. You can get access to these date on this site :

I wrote a long-tweet about the fact that $BTC was getting closer and closer to its ATH price, while we are still far from any proper “altcoin bull run”, which means that we would certainly see the BTC ATH crossing ($69k) and then only the altcoin insanity would begin. You can read it here :

On the $ETH front, we are now at $2750, and ETHBTC is somewhat struggling but went back (from below) to the support/resistance level of 0.0535. Now that we are close to 3 months away from the deadline for the $ETH ETF decision, and knowing the track record of BlackRock ETF filings (only 1 denied out of 500), and knowing that Franklin Templeton also filed this week for an ETH ETF… there’s a strong chance that we might get an ETH ETF rather soon and that $ETH will perform strongly in the 3 months to come. According to Polymarket, the likelihood of an ETH ETF approved by May 31 is 42%.

$MAVIA and the gaming narrative

One of the main narratives this week has been gaming. Gaming has been a hot trend during the last quarter of 2023, especially in November, juste like AI. And I think these 2 narratives will continue to remain prevalent during the whole bull run.

This time, the main catalyst if we had to find one is probable the giga-pump by $MAVIA post launch. MAVIA is a new gaming coin, and it is the “Clash of Clans of blockchain”. It launched the same day as $DYM, which was more hyped, so there was not so much attention on it, and it went from $2.5 (the actual post-launch dip went to $1.8) to almost $10.

One of the most vocal proponents of $MAVIA on CT was Andrew Kang, who remains giga-bullish on it :

Beam has some sort of partnership with Heroes of Mavia, which can be a reason for the massive outperformance by $BEAM too, with +70% gains in a week. Other top gaming coins performance are :

$SUPER : +84%

$PRIME : +40%

$BIGTIME : +40%

$IMX : +39%

$ILV : +33%

$SHRAP : +29%

I mentioned on Twitter that it was a good idea to follow Alex Becker and his calls / videos. He has more than 1M Youtube subscribers and is uber bullish on crypto gaming. DO NOT buy a coin because he mentioned it, but you should know which of the gaming coins are his favorite ones, as a lot of people will blindly ape on his calls.

Alt L1s

The alt L1 trade will never stop. $SEI, $SUI, $SOL, $AVAX, $KAS, are all up more than +20% this week. $SEI is now once again very close to its ATH, and it remains one of my favorite alt L1 picks. It has been helped by Hsaka being bullish on it, and this won’t stop. Hsaka is a trader that has several hundred thousands followers on Twitter and his “calls” (they are not calls to be fair to him, but this is how the market interprets them) can pump the coins. During the last bull run, his favorite coins were $SOL and $AVAX, and they still are, but now you can also add $SEI, and probably $SUI to the list.

$SUI is now close to $2, up +150% from the beginning of the year. Its chart is very clean, with consistent higher lows. Its FDV starts to get quite high though ($20bn), which is why I have more size on $SEI, at a third of SUI FDV.

The new L1 that pumped a lot this week is $ZETA. It found a support around $1.2 a week ago, and is now up 2x from there. I don’t exactly understand what ZetaChain is, but I think the keywords are L1 + RWA + China.

$BTC beta coins

As $BTC is going up in the same time as BTC.D (which means BTC outperforms A LOT of coins, and that is rare in uptrends), BTC beta coins naturally behaved very well too. The main one is $STX (as usual), and it is up +50%. The bull case on $STX is to compare the biggest ETH L2 FDV ($ARB) to the market cap of ETH, and then consider that the ratio should be the same for the FDV of STX over the market cap of $BTC (because it is a “layer 2”). That is just one thesis if you wanted some moonboy maths !

Another BTC beta coin, $ORDI, the leader of the ordinal/BRC-20 narrative, is also waking up after a severe underperformance post ETF. It is up +32% this week.

The ERC404 narrative

I mentioned in last week’s edition the launch of $PANDORA, the first token of the new ERC404 standard (=both an NFT collection + and ERC20 altcoin). It continued its run until it topped around $275M in market cap. Now it is still close to $200M. All of the attention of the market was on ERC404 during something like 3 days, and now that all the market is pumping, people have shifted to other new shiny objects, but as I see that $PANDORA is holding strong, I think we are going to have a 2nd round on this whole narrative.

The $STRK launch and ZK narrative

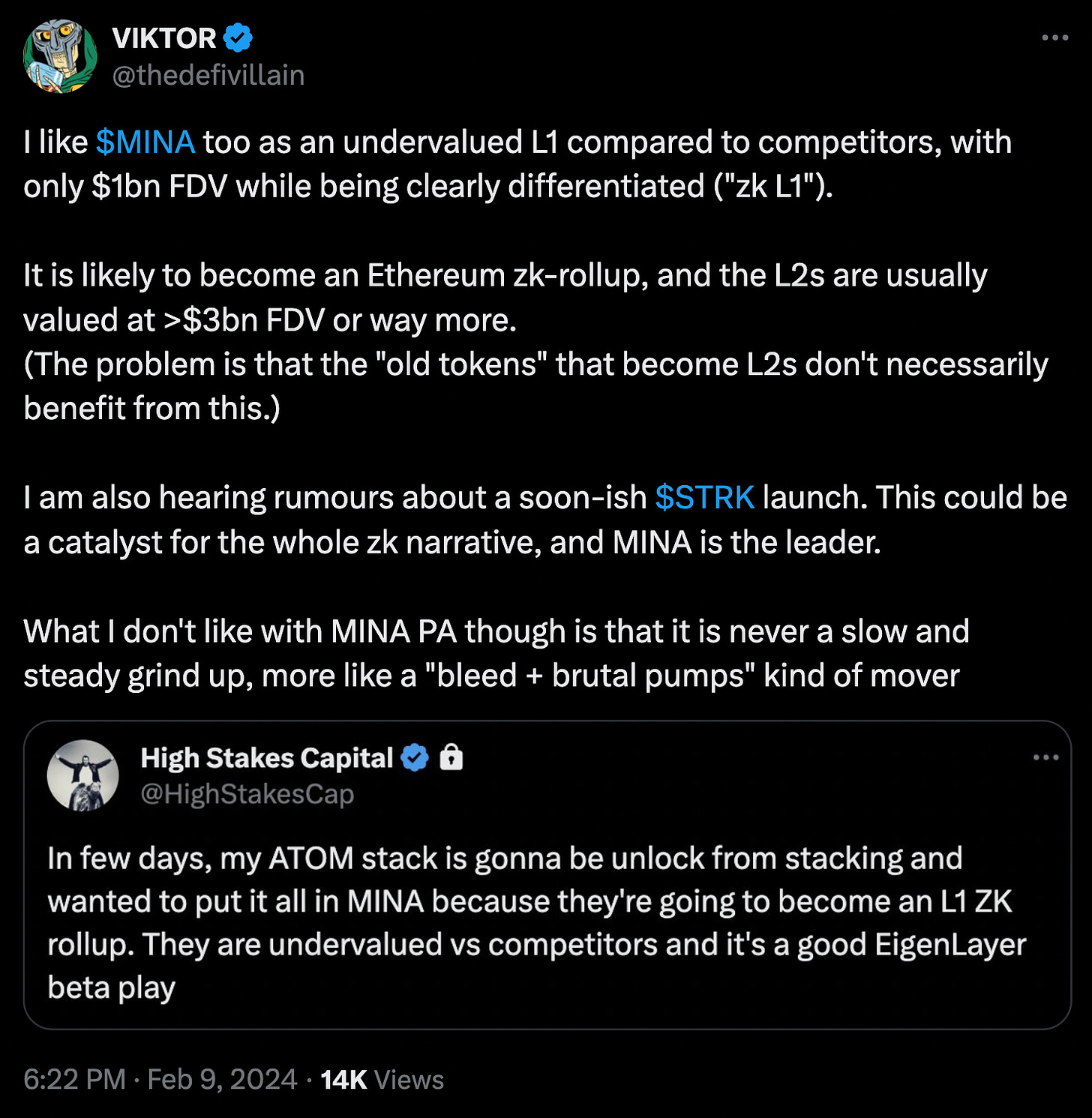

StarkNet announced that they were finally going to launch their token on Feb 20. There were a lot of rumors about it, so this is not exactly a surprise. I wrote a few days ago that buying ZK coins could be a good idea, as the potential $STRK launch would be a good catalyst for the narrative. My favorite coin in this category is $MINA, as I explained here :

$MINA has been performing well since this tweet (+20%) , and it could continue, if people consider that they want to be exposed to the StarkNet narrative without buying $STRK.

The pre-launch markets opened for $STRK, and it is currently trading close to $20bn FDV on Aevo :

That is too much in my opinion, at least too much to be a good entry. If it was anywhere below $10bn FDV, I probably would have bought some, but not at these prices.

$MOG and the revival of on-chain summer memecoins

When everything pumps, memecoins pump too, even if the hype seems to have died down. $BONK is +33% this week, respecting the 0.00001 support. But the most impressive one on Solana is $WIF, which is up +150% in 7 days, and ready to get into price discovery. Surprisingly, I hardly see it mentioned on my timeline.

And even more surprisingly, some of the ETH on-chain shitters are waking up again. The main one is $MOG, which has been able to consistently print higher lows for a few months, and it accelerated this week and is now into price discovery after managing to get higher than its summer ATH.

All the “on-chain summer” shitcoins have been following and reacting positively too : $BITCOIN (+44%), $JOE (+270%), $SPX (+40%), $SMURFCAT (+130%).

$BANANA, which is the TG bot that launched its token around the end of that on-chain season, seems to finally perform well in terms of price, it is up +50% this week and in price discovery. As for shitcoins, $TRUMP remains on a tear at $150M market cap, in price discovery after a new higher low.

What else happened in the altcoin market :

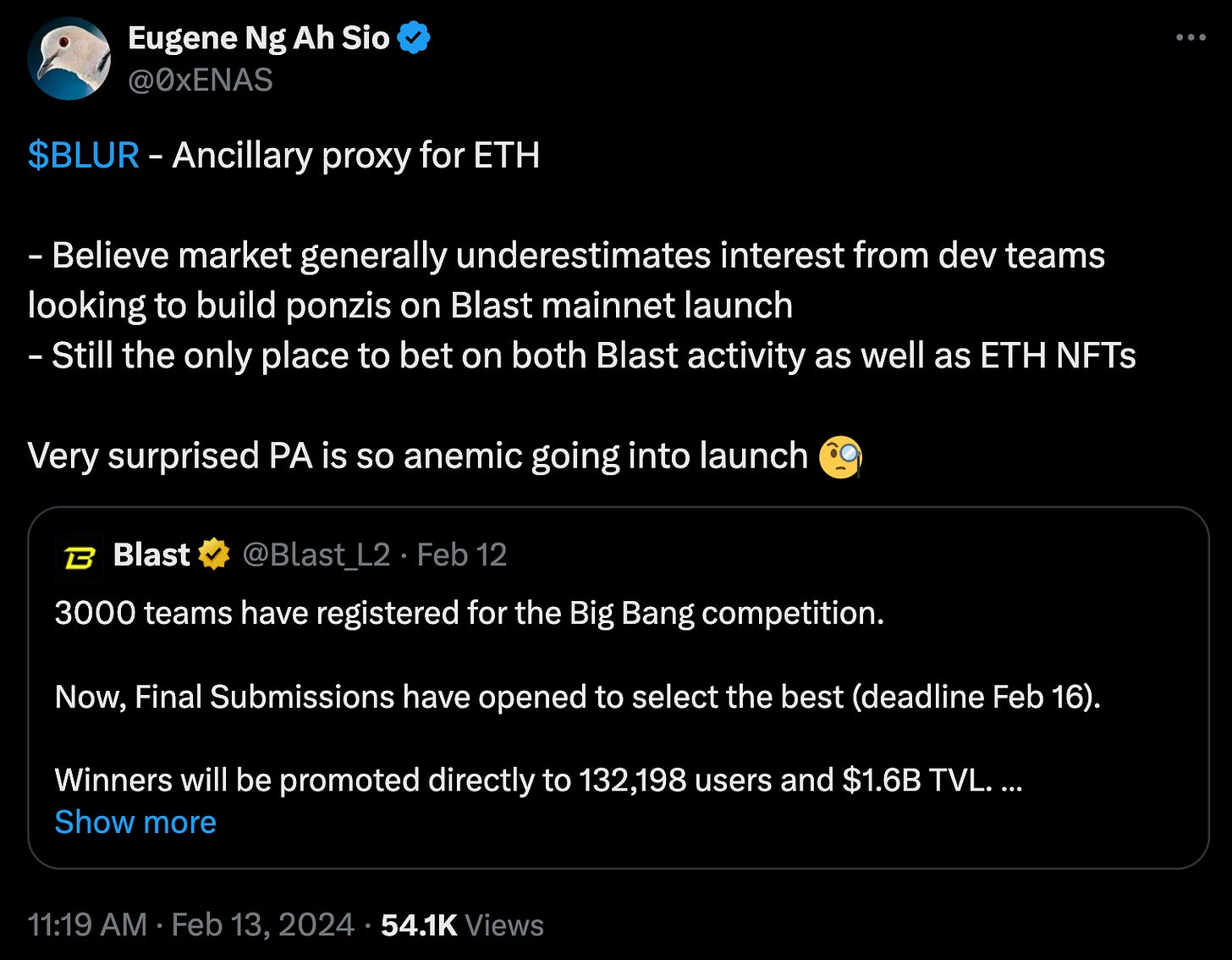

$BLUR is up +25% this week, and the bullish thesis is clearly explained by Eugene in that tweet :

$PYTH is in price discovery and continues it linear uptrend. The other main SOL token launched recently, $JUP, is struggling, and remains flat around the $0.5 Schelling point.

A noticeable strong coin is $NTRN, a pure Cosmos play that looks ready to go into price discovery, and that is part of the whole modular thesis.

$ASTR does have a very nice chart, as it is consolidating around $0.18 and looks ready to finally burst through this $0.2 resistance at some point.

Surprisingly, the INCEL trade ($INJ and $TIA) is not doing too well, despite the fact that they have been two of the strongest coins during the last quarter.

New coins are mostly doing good, and many of them are in price discovery or close to : $AI, $DYM, $ALT, $ONDO. Traders love to go with the new tokens when the market conditions are bullish.

A new ETH coin has attracted insane on-chain volume today, it is called Arbius $AIUS. I really don’t know much about it, besides the fact that it is AI-related and has a lot of attention right now.

Thank you for reading this article,

Cheers,

Viktor.

Ref link shill :

My favorite exchange is Bybit, it is where I take most of my perp trades. If you want to start trading there, you can use my referral link by clicking here or use my code 6Y2XOR

If you prefer to trade on a decentralized avenue, you can go to Aevo which has been very responsive to new launches as it even enables trading of pre-launch tokens (JUP, DYM, BLAST…) : https://app.aevo.xyz/r/VIKTOR

Good stuff mate

Awesome work as usual Viktor, thank you!