Welcome to this weekly recap, I am Viktor and you can find me here on Twitter and here on Telegram. Enjoy your reading !

$BTC and the market overall

I don’t think there is really much to say on the $BTC front, we are still in the $41k-$44k range, without meaningful moves. During a few days, $BTC almost did not move around $43.8k, while BTC.D was going down, ie altcoins have been going up overall. But in the last 3 days, $BTC has started to get weaker, and it is now around $42.4k.

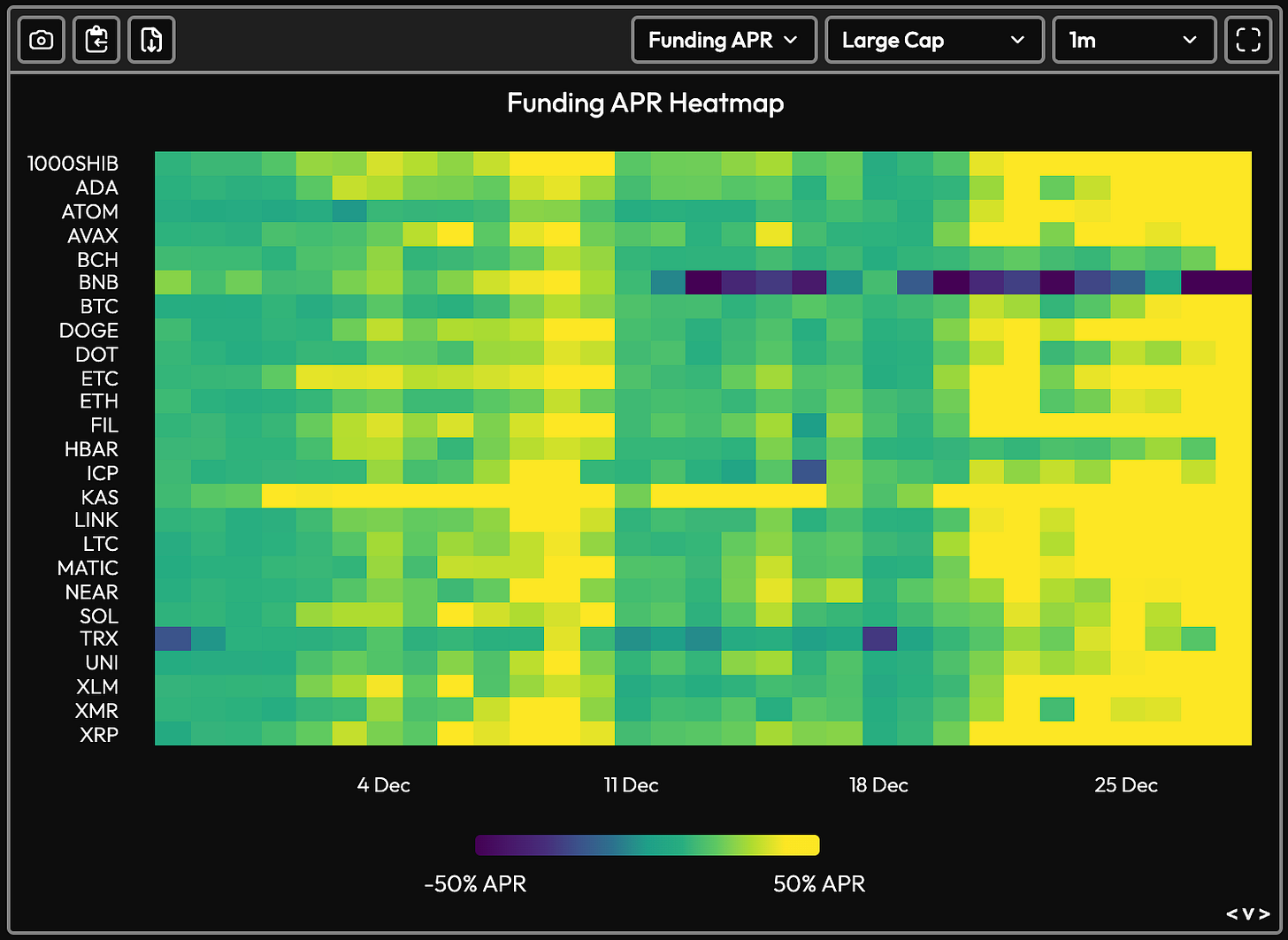

In the same time, we have seen the funding rates on altcoins get quite high, and remaining there. This means that people are longing with leverage instead of spot, and it is not very healthy. In the same time, funding rates can remain high during long periods in bull market, so this is not a sufficient indicator to determine if the market is going to dump.

Many people are expecting a sell the news event after the ETF announcement early January, but the more we dump before the ETF, and the less likely we are to sell the news. Anyway, I am ready to buy all the dips to $30k if a dump happens in the days to come or after an ETF approval !

One bullish thing to keep in mind though is that despite the fact that $BTC is choppy, most crypto-related stocks are still going up only, so there is definitely tradfi appetite for crypto.

ETHBTC finally pumps, $OP outperforms

ETHBTC managed to find a new low on December 20 at 0.050, but this breakdown was a trap, because it quickly bounced to the descending trendline. ETH beta coins naturally pumped even more, especially $OP and $ARB. Then ETHBTC stabilized during a few days and finally pumped again significantly yesterday, with ETH beta coins all doing very well. Over one week and despite the recent dump, the performance of these coins has been really strong : $OP (+65%), $ARB (+37%), $LDO (+38%), $MATIC (+31%), $ETC (+17%). $ETH stands at +8% gains this week.

$OP seems to be the best “levered ETH” bet : it was the top performer among these coins from October 16 to right before this pump, and then it outperformed again this week. Winners average winners… With EIP-4844 planned for February 2024, the ETH L2 trade made a lot of sense, and might still be a good play going into 2024.

I have not included $METIS and $BOBA because these are smaller coins but they are both L2 coins too, and have pumped this week. $BOBA had a very brutal +180% pump in one day, and then the obvious rotation that I missed was to long $METIS… that went up +150% after that.

Solana and the alt L1 trade

$SOL new yearly high

The first part of the week (last 7 days) was dominated by the $SOL move from around $90 to close to $125. This corresponds to a local top at $53bn market cap, while it was only $8bn three months ago. The following days have been 3 red candles in a row, and $SOL is now back to $103 now. It seems very likely that this was the local top for a few weeks, because reaching $120 before the end of 2023 was absolutely unthinkable even for the traders that were the most bullish on SOL.

A noticeable lesson is that most of the Solana ecosystem coins did not act as beta coins for $SOL, especially the recently launched $JTO and $PYTH, that have basically been down only versus SOL after their initial push. The best performer in the Solana ecosystem this week has been $NEON, which is an “EVM x Solana” coin and that has been absolutely ripping in the last 2 months : it 50x’ed from the October lows, and 3x’ed over the last 10 days.

I wrote last week that I thought that $BONK reached a local top and would bleed for some time, and that is what we are witnessing : despite $SOL performance, $BONK has been going down only. After a gigantic run, memecoins need some time to “reset”, so this behavior is quite usual. Many memecoins suffered this week too : $WIF is down -55% from ATH and $COQ (on Avax) is down -68%.

Other strong alt L1s : NEAR, SEI, BNB

This $SOL run ignited a whole alt L1 pump. The strongest one has been $NEAR, that did almost 2x in a week, and is up over +300% in 2 months, while being not so much mentioned across CT.

$SEI, the “parallelized EVM” coin (mentioned in last week’s edition), remained very strong this week, and reached a new ATH at $0.55. In a similar sector of “fast and cheap transactions” chains, $APT (+22%) and $SUI (+17%) also had a good week. $SUI almost never had its time in the spotlight since its launch, as it has never had a sustained pump, but I think this will happen at some point.

$BNB is also worth mentioning, since it finally had a reaction against $BTC : it had been bleeding versus the market since the FTX downfall, but is up +44% in December. $CAKE, the direct BNB beta coin, is also up more than +40% this week. I have been accustomed to see $CAKE go down relentlessly during the last 2 years, but 2 months of broad market rally brought it back to levels it first reached in June 2022. $CAKE is not a coin that I would short, even as a hedge, but I probably won’t long it neither.

MINA and the zk narrative

$MINA is another alt L1 that was among the best performers this week : +40%. You might remember that $MINA was the talk of the town during the January-February echo bubble, as it was the leader of the “ZK narrative”. I like $MINA because it is the only zk L1 that people really know about, and its market cap is quite small ($1bn), so this means that there is a lot of room to grow, and in the same time almost all the supply is in circulation. If the zk category catches a bid, $MINA is probably going to do very well.

The Polkadot ecosystem

Even the alt L1 $DOT, which has been a massive underperformer during the bear market, managed to be +16% up this week. $KSM, the “little brother” of Polkadot and its canary network, went up more than 2x before a slight correction. The two “EVM on Polkadot” networks were also among the best-performers of the week : $GLMR (+100% before dumping) and $MOVR (+600% before getting cut in half again !)

BRC-20 and Ordinals

BRC-20s had a run up in the first days of December, but have been stable since then, and finally had a new push this week, with $ORDI reaching a new ATH at $82. It is still +40% up this week. I remain bullish on BRC-20 and especially on $ORDI, as I consider that it is an entirely new sector on the back of the king of the crypto market ($BTC), and that there is no real ceiling on the valuations as holders are full of dreams.

Just like memecoins, a multi-billion dollar valuation for $ORDI is possible. But the best plays in BRC-20 land are probably tinier new coins that I don’t even know about because I did not research this sector so much. $MUBI, $BSSB, $TURT (which are available on Ethereum) did not react very strongly to the $ORDI pump.

I highly recommend you to watch this interview of 0xWangarian by Taiki on Twitter, Wangarian mentions a lot of useful crypto trading lessons and investing frameworks, such as the distinction between the PvP and the PvE trading environments. He is bullish on AI and BRC20 as two PvE sectors (this means that it is easier to make gains than in PvP).

Shitty forks of majors

A forgotten “ETH beta” coin has been pumping this week : the forked ETH proof-of-work version $ETHW, that is overall up +50% this week.

It is funny to notice that another shitty fork coin is among the top performers during the last days : $BSV (”Bitcoin Satoshi vision”), which has almost 2x’ed in two days. $BCH, as a logical catchup trade, also managed to pump +18% up.

Gaming coins

Gaming has not been uniformly strong, but a few coins have been outperforming. $AXS in particular had a +50% pump in less than two days, but has since lost close to half its gains. $RON, which is the gaming L1 built by the Axie team has logically performed well too, it is up +22% this week. $RON is up 5x from its October bottom, and Ronin is one of the 2 main gaming infrastructure coins, with $IMX (which I prefer, even if its FDV is 2.5 times larger).

Other outperforming gaming coins this week include : $PYR (+33%), $YGG (+18%), $GMT (+15%), $ILV (+12%), $SUPER (+13%), $ENJ (+14%), $SHRAP (+14%).

Bonus tweet with a useful tip :

Thank you for reading this article,

Cheers,

Viktor.

P.S. : If you liked this recap of the crypto narratives of the week, I would be pleased if you could share it to some friends that could be interested too ! I've enabled Substack referrals, so you can use your referral link, and if you refer people, you are entitled to rewards (USDC). See the leaderboard here.

Great work as usual ser