Welcome to this weekly recap, I am Viktor and you can find me here on Twitter and here on Telegram. Enjoy your reading !

$BTC and the market overall

So here it is, the $BTC ETF has finally been approved ! Great news for the long-term perspective of the crypto market that we all trade.

This week’s edition will mainly be focused on the chronology of events of the week, because there has not really been “narratives” in the market, as the ETF sucked all the attention of the market :

January 5-8 :

From Jan 5 to Jan 7, not much really happened, $BTC was close to flat around $44k. It was the weekend, and the final SEC deadline to approve or refuse the BTC was on Jan 10, so there were potentially 3 days where traders at to be in front of their screens all day long for news.

On Monday (Jan 8), market suddenly fomo’ed into $BTC and BTC beta coins ($STX, $T and $RIF), in a sort of ETF approval frontrunning. $BTC reached new highs at $47k.

January 9 : fake ETF approval news day

On Thursday (Jan 9), $BTC remained flat while $ETH bled from $2350 to $2250, and ETHBTC found a new bottom at 0.048. I even posted about it.

And then, around 4pm, the official SEC Twitter account posted a tweet stating that the $BTC ETF was approved. I was expecting a very strong pump of around +10% on the news, but that is not what happened : $BTC did not even have a +3% pump in 3 minutes, and then started retracing immediately. The very interesting lesson is that ETHBTC started to go up around 3 minutes after the announcement… which basically meant that the BTC → ETH rotation was beginning its march.

Around 15 minutes after the “approval”, Gary Gensler posted on his Twitter account that the approval news was fake and that the SEC account had been hacked… hilarious and almost unsurprising that this had to happen in our clown industry. Naturally, the market slightly dumped on the news, but then $BTC stalled while $ETH was trending up, as well as ETHBTC. Here is a tweet I posted after that :

It was clear to me that the market “showed its hands” on that fake approval, and ETHBTC spiking on the news was good evidence that the market was finally ripe for the ETH rotation. You probably remember that the initial catalyst for this whole ETF-driven pump of the last 3 months came from a fake ETF approval tweet by CoinTelegraph. What happened back then is also that the market showed its hands, and everybody realized that they were under-allocated to $BTC, so then everybody tried to frontrun the ETF approval by buying $BTC and we went from $27k to $47k in less than 3 months. The same phenomenon happened on this SEC fake approval.

January 10 : ETF approval day

January 10 was the last day for the SEC to approve (or not) the ETF. Not much happened during the day, and the approval happened around 3pm. As we had already seen that $BTC would probably not pump a lot on the news, this is what happened, there was a lot of volatility up and down in a small range for an hour, but ETHBTC started going up as soon as the ETF news came out. Most of the altcoin market went up in the following hours, with a first wave pump dominated by ETH beta coins, and a second one dominated by alt L1s and the usual strong coins of the last 3 months

January 11 : ETF first trading day

I initially thought that the ETF trading would start way after the approval (several weeks or even months after), but actually the BTC ETFs started trading immediately in the day after the approval. Basically what happened is that $BTC trended up in the hours before the US market opening, had a final spike from $47.6k to almost $49k [this is when all the “sell the news contrarians” were celebrating], and then completely puked to $46k.

January 12 : ETF second trading day

Friday has been a similar story as the day before : as soon as the US market opened, $BTC went south, from $46k to $43.5k. $ETH resisted better, and ETHBTC went to new highs at 0.061. But a second dump happened yesterday, which pushed $BTC to now stand at $42800 and $ETH at $2580.

A few lessons from the past days are the following :

ETH is now definitely stronger than BTC. The market is looking forward, and the next main catalyst is the potential $ETH ETF. If you look at the BTC/ETH chart, there is a very clear “sell the news” pattern, at least in the sense that the market immediately rotated from BTC to ETH.

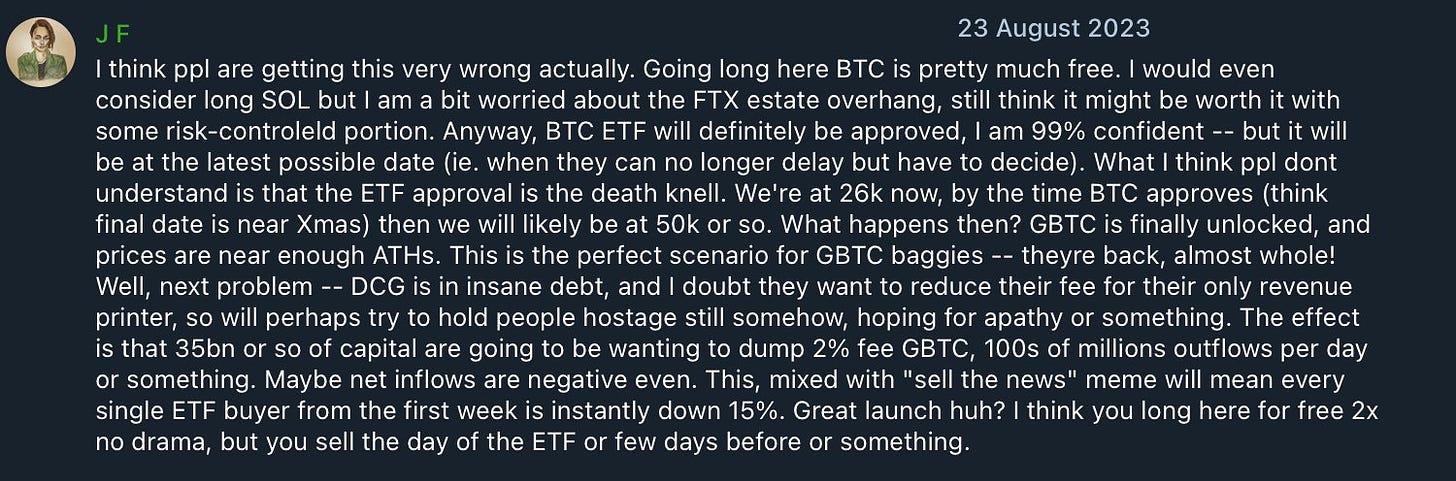

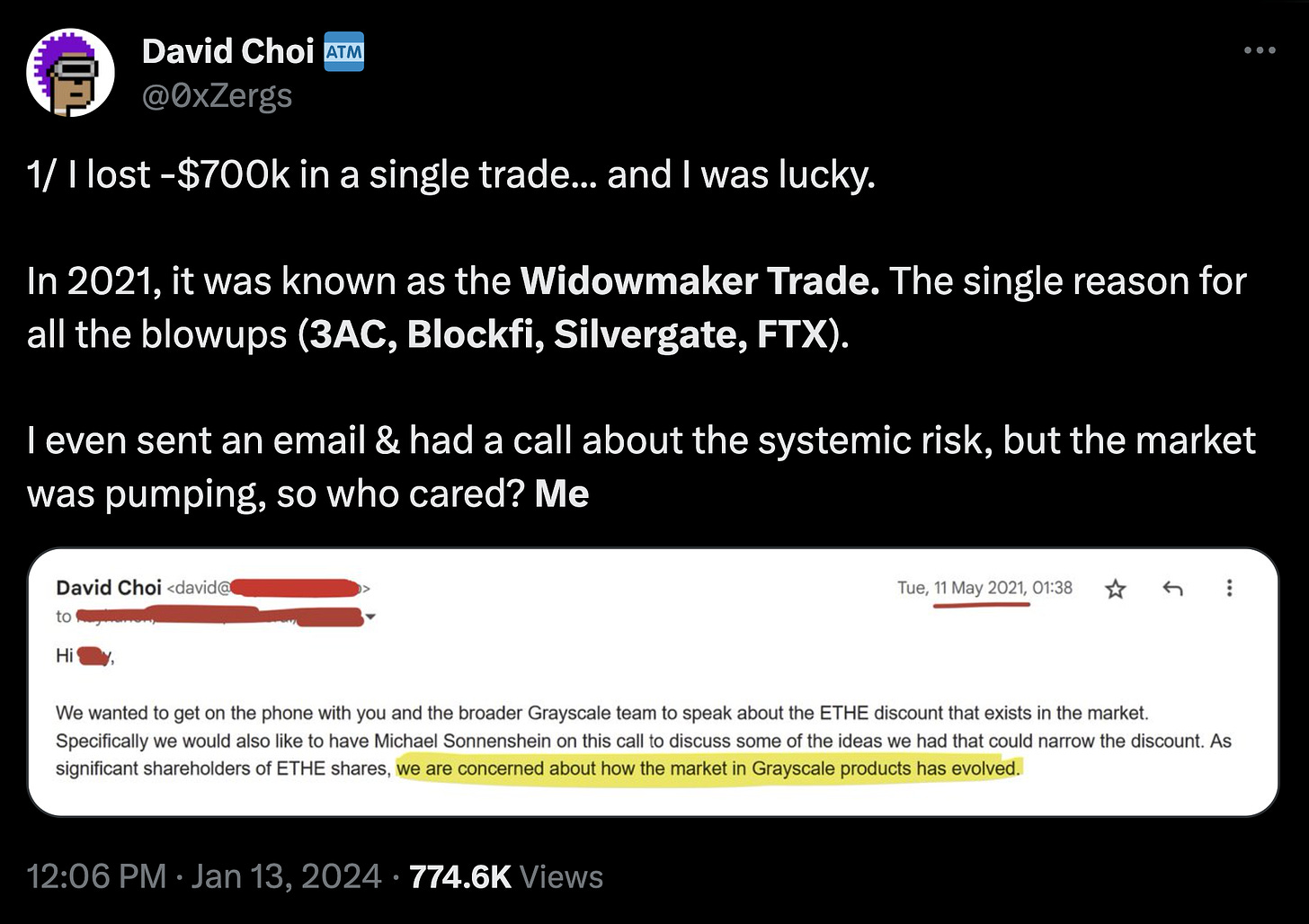

If one specifically looks at what happened during the US market trading hours, one can see that there is a very clear pattern of selling off during the first 2 hours. Of course, the size of the sample is only 2, so there is nothing conclusive here, but we can speculate about what is happening. One possibility is that all the people that wanted to get out of $GBTC (which has now become the Grayscale ETF product) are now finally able to do it at close to no discount… some of them might rotate into other BTC ETF products, but some of them might simply represent outflows from $BTC. Cobie wrote about this back in August 2023, with hilarious prescience :

$GBTC represents $26bn assets under management, which is potentially a massive selling pressure. Another source of selling pressure can be the CME, because it looks like tradfi went hugely long bitcoin in the last months to play the ETF catalyst. And finally, seeing $BTC sell off right after a +70% pump is absolutely normal, we don’t even have to find a specific origin for that selling, many people are up a lot, they will take profit now that the ETF is approved.

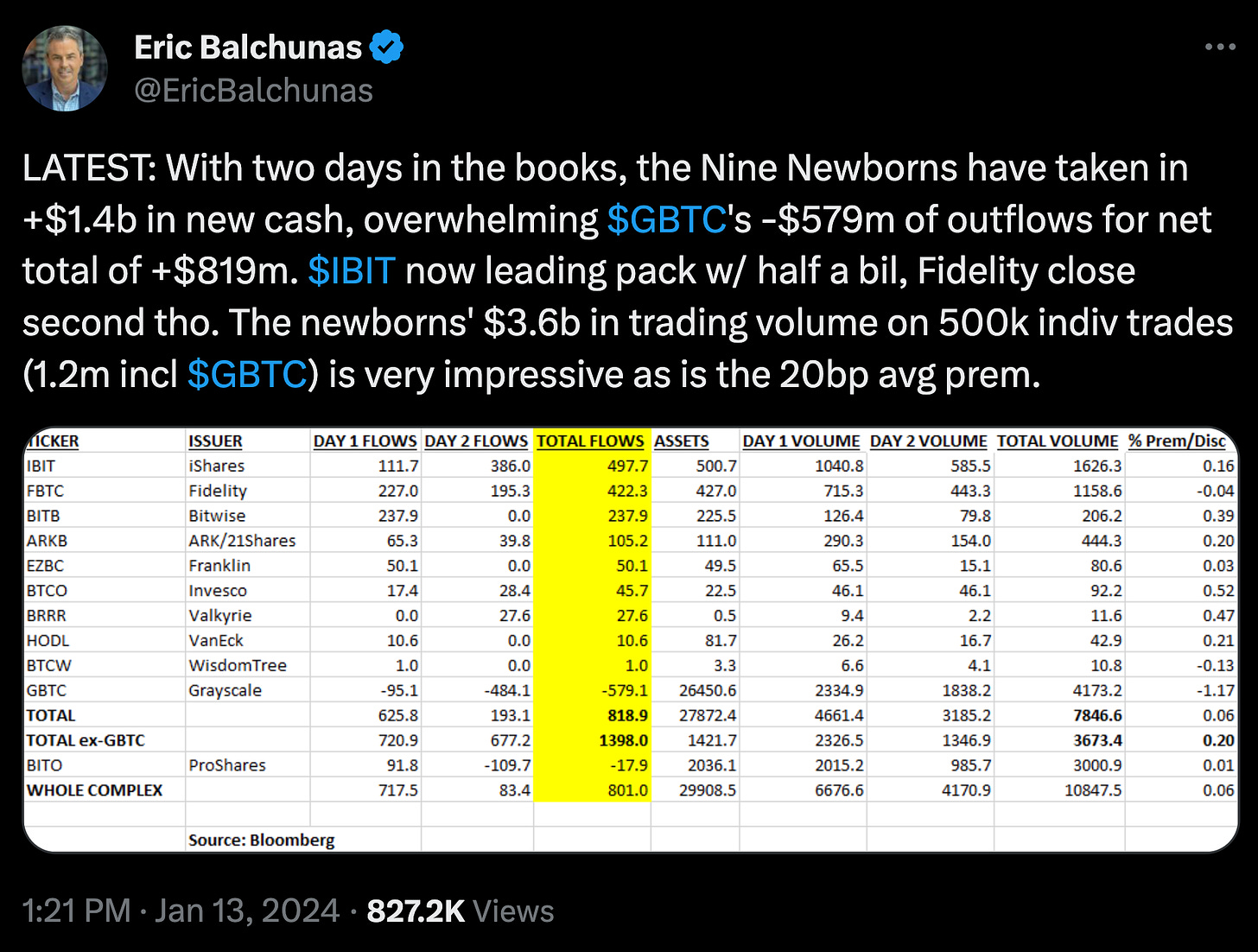

According to Eric Balchunas, who is one of the ETF specialists of Bloomberg, the total inflows of the ETFs so far have been +$1.4bn, while the outflows from GBTC are around $600M, so +$800M of net inflows. Largest winners are BlackRock, Fidelity, and then Bitwise.

Given the fact that $BTC has been going up so much in the last 3 months, I am not surprised to see a correction, and I honestly expect it to go down more, but probably not too much, because a lot of people who have been vaguely interested in crypto have realized that they missed the first train, and want to jump back in. Any drawdown is an opportunity for them. I might be totally wrong there, but this is what I feel from talking with people.

What happened in the altcoin market :

The best performing category of the week has naturally been ETH beta coins :

$ENS : +74% this week, mainly thanks to the fact that Vitalik tweet about it recently.

$ETC : +46%, a forgotten ETH beta that reacted strongly this week as people were looking behind the usual LDO/OP/ARB trio.

$BLUR : +29%, ETH season means NFT season, and BLUR is a Blast “beta” so it will get attention, as Blast TVL gets unlocked in February.

$PENDLE : +32%, a way to play the Eigenlayer/restaking narrative + a coin that has been consistently strong all year long.

$MNT : +29%, a “forgotten” L2 that is getting attention because of its liquid staked $ETH, $mETH, with double yield.

$METIS : +28%, a smaller L2 in market cap that requires less capital to pump its token

$ARB : +23%

$MKR : ETH DeFi 1.0 juggernaut + leader of the RWA narrative + huge roadmap with a ticker rebranding

$OP : +17%

The other top performers are mostly random in my opinion :

$SUI is up +60% this week. People have been trying to force the $SEI ⇒ $SUI rotation during the last weeks, but it never really materialized. $SUI is one of the last “major” new alt L1s that did not have its time in the spotlight… and it definitely had to happen at some point, so this week was the week ! $APT (the other Move-based L1) followed as a catchup trade too.

Solana memecoins are hot again : someone spent $8M in one transaction to buy the dog coin $WIF, which caused a 20x wick on the price of the token and then the loss of that trader instantly reached multiple million dollars… this story is quite crazy and I can’t explain it, but $WIF is now up +150% this week. $MYRO, which was at some point the second biggest Solana dog coin (before the $WIF launch), is also up +130%, after several weeks of consolidation. $BONK is also back from the dead with +40% gains after its down only trend post pico top.

$JTO has also been in a never ending downtrend after its initial pump, but it looks like it is now reversing the trend, with +35% gains this week. $PYTH is following the exact same path.

$HNT (Helium token), one of the leaders of the depin narrative, and a Solana coin, is up +40%. Keep it on your watchlist !

A new coin on Arbitrum launched this week : $XAI. It seems to be an Arbitrum L3 dedicated to crypto gaming.

Berachain announced the launch of its Artio testnet. The buzzwords for this chain are : EVM-compatible, Cosmos-based, new “Proof of Liquidity” consensus, high performance. It is a promising alt L1 that you should keep on your radar.

Some good tweets / threads :

What’s next ?

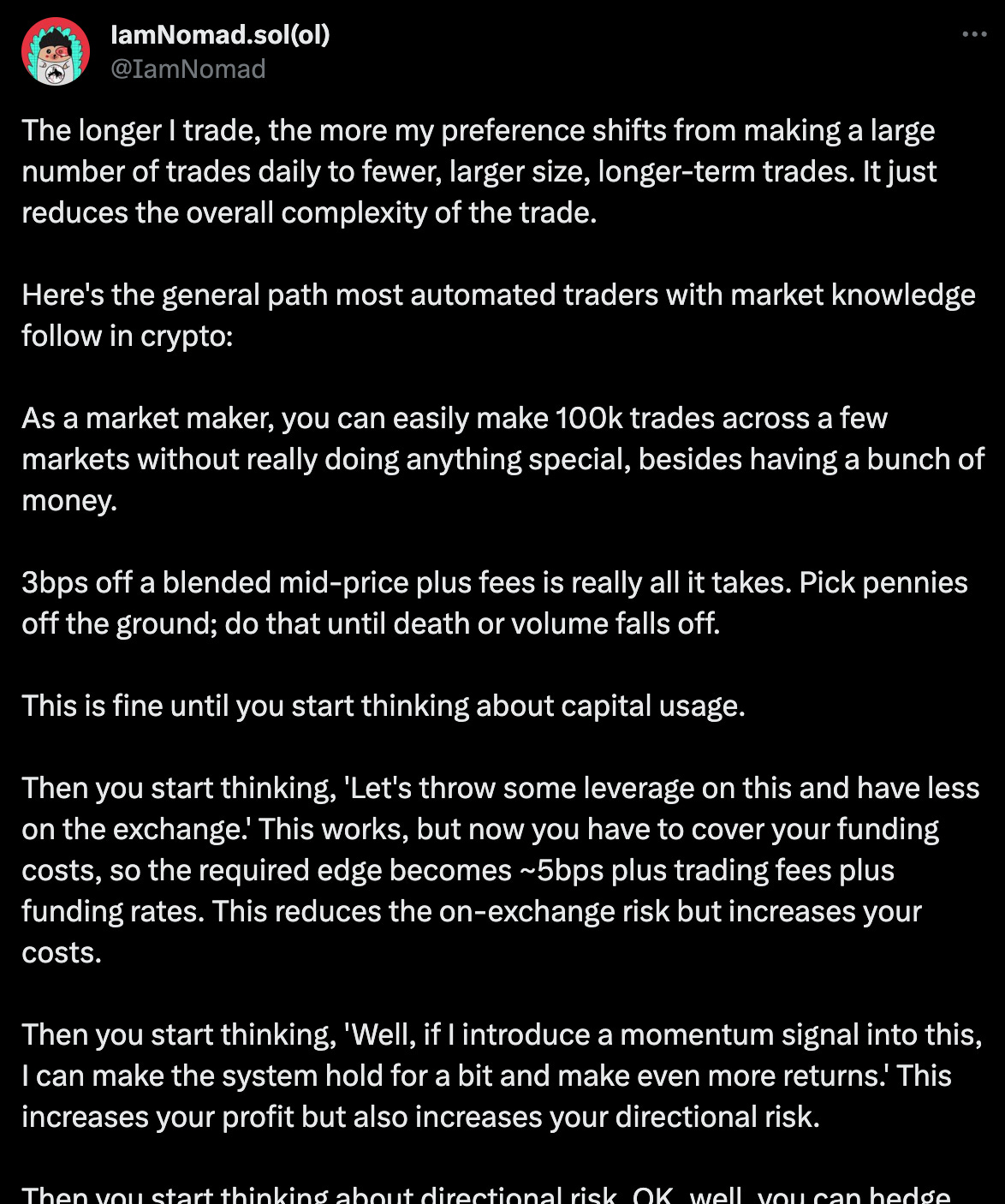

Fewer, larger size, longer-term trades :

How to avoid stress in trading :

Part 3 of the ETF trade :

Coinbase IPO type of top ?

ETH ETF is not a certainty at all :

The BTC ETF is very bullish on a several months timeframe :

Live commentary thread of spot flows on Coinbase by CL :

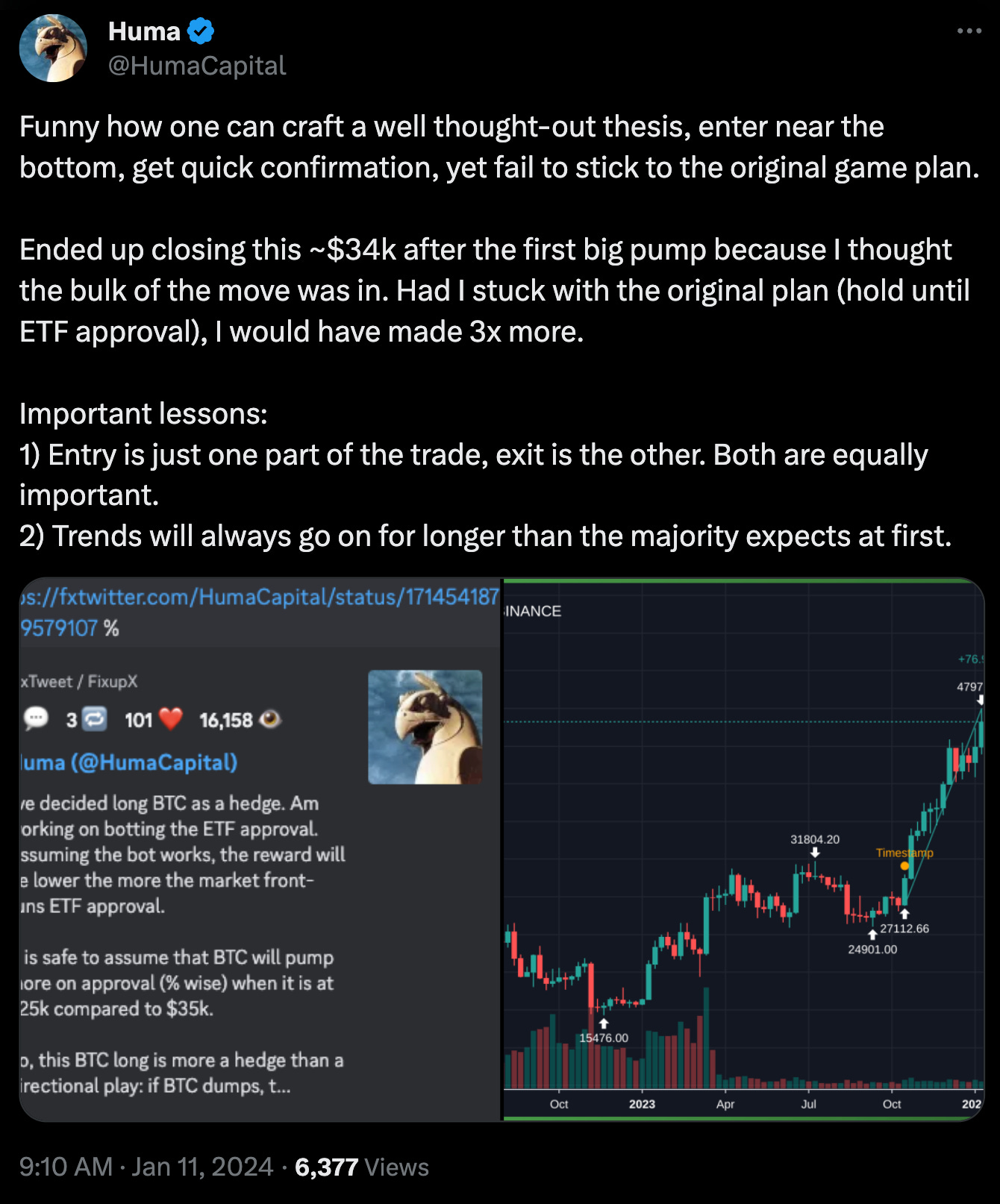

Important trading lesson :

Musical chairs :

We won a decade long fight :

Why TIA is going to be this cycle’s (3,3) :

The GBTC widowmaker trade :

Thank you for reading this article,

Cheers,

Viktor.

P.S. : If you liked this recap of the crypto narratives of the week, I would be pleased if you could share it to some friends that could be interested too ! I've enabled Substack referrals, so you can use your referral link, and if you refer people, you are entitled to rewards (USDC). See the leaderboard here.