November 2023 recap : narratives, best-performers, and coins to watch

Gaming / AI / $SOL / new coins

Welcome to this monthly recap, I am Viktor and you can find me here on Twitter and here on Telegram. Enjoy your reading !

Ref link shill : My favorite exchange is Bybit, it is where I take most of my perp trades. If you want to start trading there, you can use my referral link by clicking here or use my code AOZDLZ6

Main events that happened in November :

The most important piece of news for the crypto market this month has probably been the news about Binance and CZ : as you know, the DOJ had filed a case against Binance, and we were all waiting for a conclusion about this. We got it this month : Binance will pay a $4bn fine to the DOJ, and CZ had to step down as CEO (replaced by Richard Teng). This conclusion is mostly bullish for the market because this is far from the most catastrophic scenario we could have pictured, and Binance will be able to stomach the fine and continue operating, without danger for the customer funds.

One of the main pieces of news during this month has also been the $ETH ETF : on November 9, we learned that BlackRock was filing for an $ETH ETF too. This caused a surge in ETHBTC from 0.052 to 0.058, and we are still in that range right now, at 0.0545.

$BLUR had their season 2 drop on November 20 (which is similar to a token unlock in terms of pressure on price), and it is also the day the team chose to announce the launch of Blast, which is an L2 “with native yield” (ETH staking yield and $sDAI t-bill yield) built by the Blur team. Blast is currently a simple multisig contract which has attracted more than $600M TVL in one week. People can deposit funds there to farm Blast points, but their tokens are locked until February 2024. The success of Blast also triggered a price surge in $BLUR, which went from $0.30 to $0.67 in 4 days. $BLUR can be considered as a proxy coin for the NFT market, so it could be a very good long-term position.

The OpenAI drama happened in the middle of the month : Sam Altman has been fired from OpenAI before getting back as CEO a few days later. It was the talk of the town in the tech world during two weeks, and AI coins mostly benefitted from this attention.

There have been a few new coin launches in November : $TIA (Celestia), $MEME (Memecoin), $PYTH (the Chainlink of Solana), $FLIP (a native-swap DEX similar to Thorchain), and $VRTX (the token of the Vertex protocol, a perp DEX similar to DYDX). All of them performed well, and had had at least one pump. I think that we are in an environment where punting new coins is highly rewarded. We are always trading attention, and the market is risk-on, so people are looking for things to buy. What could get more attention than new launches ?

A few medium-scale hacks happened in November. Two CEX related to Justin Sun have been hacked (Poloniex for $126M and Huobi for $26M). The HECO bridge has been hacked too, for $87M. Finally, the DEX KyberSwap has been hacked for $48M and negotiations are still ongoing with what looks to be a cocky hacker.

Near had their annual NEARCON conference on November 7-10. The price of $NEAR went up before that event, dumped versus BTC from Nov 5 to Nov 10, and then outperformed $BTC again.

Ripple had their Swell conference on November 8-9, and this was a great example of uptrend before the catalyst, and then sell the news 2 days before and all the following weeks. Look at the XRPBTC chart :

SpaceX launched Starship on November 18 : $DOGE did the classic “up before / down after”, but started to grind higher at the end of the month again. $DOGE is the Elon coin, watch for catalysts related to Musk if you want to trade it.

Solana Breakpoint happened from October 30 to November 3, and it has not been a sell the news event at all.

A new protocol on Terra called “Mint Cash” plans to launch UST 2.0, by locking an burning $USTC among other things, and this caused a massive surge on $USTC, that went from 1.3c to 7c in one day, and now stands at 5.3c. $LUNC and $LUNA logically had a great week too.

$DYDX had a major supply unlock on December 1st. It was the most anticipated unlocks of the month, with the Blur one, and traders spent a lot of time thinking about what could happen. It looks like it did not affect price too much, which could mean that it will perform well in the days to come, when we also factor in the fact that $DYDX is down -25% from its November top.

Main narratives of November :

Crypto gaming :

Crypto gaming is probably the best-performing narrative of the month : $ILV and $IMX are the leaders of the category and are both up more than 2X in a month. The “new” coin $PRIME is up 3x, $BEAM (which was $MC) and $RON (the L1 related to Axie) also have had gains larger than +100%. Some older coins like $GALA and $AXS or $ENJ have smaller gains but are up too. Among mid caps, best performers are : $SUPER, $ATLAS and $POLIS, $SIPHER, $SFUND.

AI coins :

AI coins have been in the spotlight with the whole OpenAI drama, and most of them did perform very well in November : $RNDR, $AGIX, $OCEAN, $FET, $AKT, $CTXC, $PAAL. Among the most recent ones, two AI coins really stand out : $TAO (”decentralized OpenAI”) and $OLAS. Both of them are already highly capitalized in my opinion, but they are cultish in a few aspects, which is exactly one of the recipes for giant gains. I explained in this tweet why $TAO is a very small bag of mine, as a “psychological hedge”.

$SOL and the Solana ecosystem :

$SOL is by far the king of the altcoins right now. It has massively outperformed the market, despite the “FTX selling pressure” that everybody was afraid about (including me), and that ended up being a nothingburger, because they sold a lot of $SOL tokens while the market was hot and $SOL did not stop pumping. I think that a lot of VCs and investors have realized over the last weeks, while ETH was weak and SOL very strong, that they might be over-allocated to the Ethereum ecosystem and under-allocated to the potential third leg of a BTC/ETH/XYZ trio, which is becoming $SOL more and more clearly.

Naturally, the whole Solana ecosystem acted as beta for $SOL, and there are so few tokens perceived as decent in Solana that all of them went completely crazy. The most obvious one is $BONK, which is the main Solana coin that has been launched in the first days of this year, and that managed to get back its ATH and even more, despite a -96% dump over the year. In one month, $BONK has done a 30x in price, and it remains the most obvious $SOL beta for me (which is why I am allocated).

The usual old SOL beta coins like $SRM and $RAY have done well, but there are now a whole new set of Solana coins that the market seems to like : $HNT (+90% in a month, DePiN coin), $NEON (+120%, “EVM+Solana”), $SCS (+440%, casino token), $ATLAS $POLIS and $AURY in gaming, $CROWN (+80%, horse race betting coin), $SHDW (+550%, storage coin?). Let’s not forget the Solana NFT collections, that are mostly going up when denominated in SOL, so you can imagine the USD gains : Mad Lads is probably the safest best (Cryptopunks of Solana ?), but there are also Tensorians, Claynosaurz, Solana Monkey Business, Quekz, Okay Bears, etc.

The other narratives :

The “winner basket” ($SOL $INJ $RUNE $LINK) that was identified in October mostly remained strong during November, especially during the first half of the month. $PEPE did not perform well this month, and as a memecoin, it tends to follow the pattern of “+50% in 3 days and then bleed for a few weeks”. $TIA might be a coin that will consistently outperform the market too. Its pump from $2.5 to $7 in a week has been noticed, and it is at a new ATH again now. $AVAX had a great performance this month too, so it might qualify as a “winner coin”, but most of the gains have been concentrated in one week and it might simply be a laggard reaction to the SOL outperformance, so I am way more confident on $SOL doing well in the future than on $AVAX.

A few Cosmos coins have been very strong during this month : $KUJI $TIA $SEI $RUNE $OSMO $INJ $DYDX. One of the unspoken rules of the Cosmos ecosystem is that $ATOM underperforms no matter what, because this coin is cursed. I am kidding of course, and the performance of $ATOM this month is okay, but it does not accrue much value from its giant ecosystem, even when some Cosmos coins have incredible performance.

Surprisingly, BTC beta coins such as $STX and $BCH have not performed very well during most of the current move. $STX has finally started to show strength during the last days, though. The main BTC beta narrative that had significant gains is the Ordinal narrative. The main ordinal coin is $ORDI, and it did close to a 10X price increase from its October bottom to its November top. We can also cite $SATS, $TRAC (”Chainlink / The Graph of Bitcoin”) or $MUBI (BRC-20 / ERC-20 bridge) as ordinal plays that had significant gains.

In memecoin land, the schizo meta that was hot during the last months has struggled a lot in November. $BITCOIN, $JOE, $MOG, real smurf cat, $SPX did all go down in price while the market was hot. The main memecoin of the month has definitely been $GROK (which is in my opinion a vanilla tasteless Elon-based memecoin but whatever…), which went from 0 to a $150M market cap in 10 days, and still stands at $100M MC. Is the Elon meta among memecoin dominant again ? That’s possible, I don’t feel very synced to it, so I mostly focus on perps right now, and I also think it’s the same for many traders now that a lot of action is back to CEX altcoins.

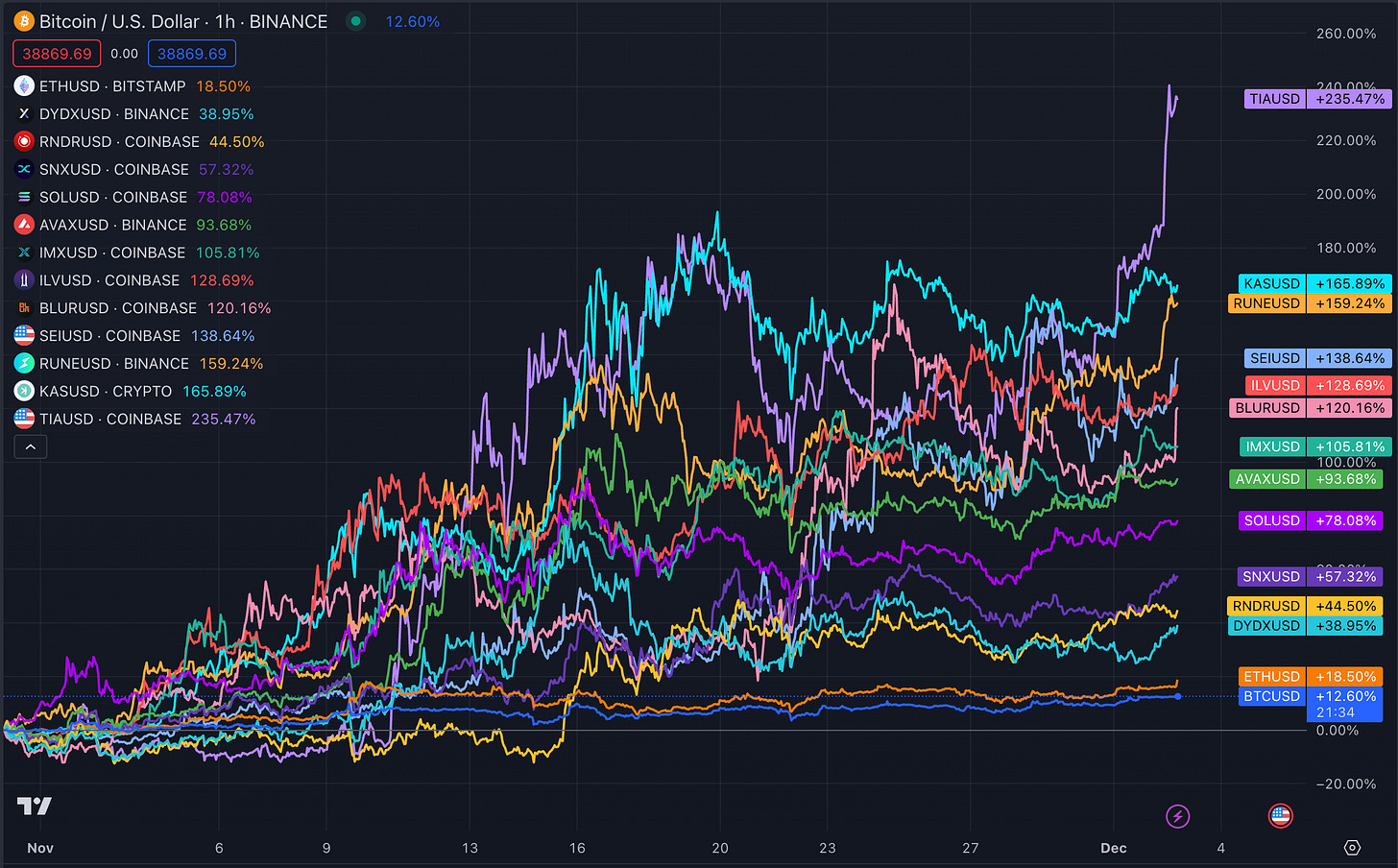

Best-performer list :

Best-performers in the top 100 over 30 days :

$TIA : +260%

$TAO : +196%

$KAS : +167%

$RUNE : +156%

$SEI : +147%

$BLUR : +142%

$ILV : +124%

$IMX : +108%

$AVAX : +88%

$KCS : +73%

$SOL : +56%

$SNX : +54%

$GMT : +53%

$RNDR : +52%

$DYDX : +52%

Smaller coins worth noting that had a good performance over 30 days :

$BONK : +600%

$ORDI : +475%

$SUPER : +400%

$USTC : +360%

$FTT : +230%

$PRIME : +175%

$SFUND : +160%

$BEAM : +156%

$ATLAS : +148%

$RON : +126%

A few additional comments about some coins and narratives :

$ETH and the Ethereum ecosystem as a whole have been mostly underperforming overall. $ARB looked strong during the first third of the month, but Arbitrum season did not really start because it then dumped versus BTC. $MATIC has also been very strong during the first half of November, and some people speculated that it would reverse versus $SOL, but that did not happen neither. I think we should not complicate things too much : as long as the market is focused on the $BTC spot ETF, the flows will remain concentrated on $BTC, and the Ethereum ecosystem will underperform. ETHBTC is likely to bottom very close to the day of the ETF approval, at least that would be logical, but some people might want to frontrun that.

Among the moderately-sized alt L1s, $KAS and $SEI have been top-performers this month too. $KAS is definitely a winner coin too (+160% in Nov), it has been unstoppable all year long. $SEI has been launched in August and has been in a “down only” mode since then, but it started stabilizing in October, and pumped a lot this month (+130%). New alt L1 + low FDV = good potential ?

A few days ago, it was announced that Michael Saylor (through Microstrategy) had bought more $BTC and, contrarily to what usually happens, the market did not immediately dump after the announcement, and his medium buying price was lower than the market price. This is additional evidence for the current strength of the crypto market.

$CAKE : Surprisingly, $CAKE is up almost 2X this month, after a very rough bear market and a literal -98% dump. I would not really like to hold this coin (old coin, under-performer during the whole bear, etc), but it is worth noticing.

Among NFT collections, the main winners have been in Solana, and on Ethereum, the best-performer is Pudgy Penguins : the floor price went from 5 ETH to almost 8 ETH in a month, and is now in price discovery. The CryptoPunks floor price also increased from 47 ETH to 57 ETH this month.

$SNX is close to a multi-month range breakout that is similar to $LINK before it doubled from $8 to $16 in three weeks. With the Infinex launch catalyst, and provided that $BTC does not dump, this could be a decent long. Now that the $DYDX unlock happened, we could see the perp DEX category pump.

During the second half of the month, the market was bit “muddy”, there has not been clear winners that outperformed the market during several days. Most of the coins that outperformed did have strong pumps during 2 to 3 days max, and then calmed down. Now, with the recent $BTC breakout, we could see longer-lasting pumps again.

If you like pair trades, I think the long $DOGE / short $SHIB trade is very likely to be profitable over the coming weeks : no catalyst for $SHIB, a few catalysts for $DOGE with SpaceX launches. If you want memecoin exposure, either you go with DOGE or the new shiny ones, but why would you choose SHIB ?

Thank you for reading this article,

Cheers,

Viktor.

Ref link shill : My favorite exchange is Bybit, it is where I take most of my perp trades. If you want to start trading there, you can use my referral link by clicking here or use my code AOZDLZ6

very nice, thanks