Narratives of the week : May 31

$ETH ETF approved, PEPE and ONDO new ATH, Trump and PolitiFi narrative

Welcome to this weekly recap, I am Viktor and you can find me here on Twitter and here on Telegram. Enjoy your reading !

Ref link shill : My favorite exchange is Bybit, it is where I take most of my perp trades. If you want to start trading there, you can use my referral link by clicking here or use my code 6Y2XOR

$ETH ETF approved !

The price of $ETH is almost at the same price as when I wrote last week’s edition (ie right under $3800), but in the meantime, we had an $ETH ETF approved, and that’s big. What happened in terms of price is that $ETH jumped to $3950 a few hours before the approval, and then had a nasty liquidation wick down to $3500 but overall the price did nothing crazy when the ETF was approved. It had a small pump, then retraced back to $3650, before grinding up to almost $4000, and since then it has been slowly decreasing.

ETHBTC is showing a similar picture, it peaked at 0.0575 and is now back down to 0.055. $BTC is around $68000, which remains overall a bullish setup.

Contrarily to the $BTC ETF, the ETH ETFs are not trading yet, because the SEC rushed to approved the 19b-4 filings but the S1s registrations have yet to be approved. When they will be, the ETF trading will start. It’s not a question of if, but when, and the current estimates is that it will take a few weeks. And yes, of course, just like 99.99% of CT, I did not know the difference between 19b-4 and S1 a month ago, but we are now ETF specialists, for real for real.

I definitely think that the $ETH ETF is NOT correctly priced in yet, BUT that repricing can sometimes take longer than expected. Which is why I think that ETH will trade much higher in a few months, but in the very short term, it could very well have some additional drawdown.

Remember what happened after BlackRock filed for the BTC ETF ? We basically had a 2-day pump followed by a bearish chop that ended with a massive liquidation day in August. And then in October the fake ETF CoinTelegraph tweet was the catalyst that actually ignited the $BTC pump in Q4 23. But that pump was mostly about pricing in the ETF, which was something that the market could already have priced in quickly after the BlackRock ETF filing in June.

I don’t think the same scenario of a massive liquidation cascade is likely, but you must be ready to withstand it if it happens, before we go much higher.

Memecoins are the best ETH beta coins ?

The “Ethereum beta coins” that performed the best after the ETF approval have been… some memecoins, especially $PEPE and $MOG. $PEPE pumped to $0.000017 (ie $7bn market cap), which is almost a 2x in 7 days, but then it retraced -20% after that. $MOG also pumped close to 2x after the ETF approval, and it crossed its previous March ATH. $MOG market cap is $500M, and I have beens saying for a long time that it had the potential to reach $1bn and beyond.

Speaking of $1bn MC memecoins, $BRETT is almost there. BRETT is now the leading memecoin on Base, and from the beginning, I have never really understood why it’s been doing so well. One of the answers is that the supply is very likely cornered by insiders. At this price, I think the r/r for a long is not interesting, but I can be completely wrong.

Another top-performing memecoin has been $TURBO. It is supposed to be “the first memecoin made by ChatGPT”, so a memecoin x AI crossover ? $TURBO is up almost 20x in May…

We can also mention $ANDY (+94% in a week), $WZRD (+60%), $MEW (+44%), $WOJAK (+40%).

With $PEPE having taken a big lead over $WIF from April to the last few days, it's probably time for a mean reversion on the WIF/PEPE pair. $WIF bottomed locally on May 27, and it would make sense that the bottom is now for the next few weeks to months.

After this multiweek outperformance from memecoins since the April bottom, it is also likely that they cool down a bit for some time, at least the largest ones. I will personally try to avoid trading them too much, and just hold, but you must always be ready to suffer some drawdown, especially after a sustained period of pumps.

$ONDO and RWA coins

Another category that seemed to react very well after the $ETH ETF approval is RWA (real worlds assets), and especially the leader of the sector, $ONDO. $ONDO has been one of the best performers among large caps in 2024, and it has finally broke out of its range broke the $1 resistance right after the approval, and went as high as $1.3. I have been long $ONDO for quite some time and have not taken profit yet. It is the leading RWA coin, and also the de facto “Larry Fink / BlackRock” coin. That is a very compelling narrative that makes $ONDO a great Schelling point. I have talked a few times about $20bn FDV being some kind of ceiling for most projects, so I plan to take profit on ONDO between $1.5 and $2.5 if we get there.

The other top-performing RWA coins have been $DUSK (+28%) and $TOKEN (+11%). I like $TOKEN, but not its large FDV…

The Trump verdict and the “Politifi” narrative

One important event of the week has been that Trump was ‘found guilty’ in its hush money trial. It obviously looks like (and is) a form of political persecution lead by the Democrats, but it is likely to reinforce Trump instead of weakening him. On Polymarket, the odds of Trump winning the election went from 56% to 54%, but these are probably overestimations since the crypto bros on Polymarket are pro-Trump skewed.

As for the “Politifi” memecoins, the first reaction on the $MAGA/$TRUMP coin (which is the leading one) was a sharp drawdown from $15 to $10 followed immediately by a bounce and now the price is around $16, which corresponds to a $750M market cap.

There is also a new Trump memecoin called Maga Hat with ticker $MAGA, and it pumped from $1M to $300M in around 2 weeks. $BODEN is consolidating around $200M and is probably a good buy here when you consider that it was at some point twice bigger than the TRUMP memecoin, and it is now almost 4 times smaller. There’s also the $TREMP memecoin on Solana around ATH at $120M, but I’d rather buy $BODEN.

What else happened in the altcoin market ?

One of the main stories of the week has been that some celebrities have been launching memecoins on Solana, for example Caitlyn Jenner and Iggy Azalea. These are d-tier celebrities looking for attention and easy money, but it is very much a nothingburger for me. It’s definitely not a top signal, because it’s obvious to me that the market is not topping here.

I mentioned $NOT in last week’s edition and said that it was a sort of stupid coin that could have an irrational behaviour before trending to zero, and it is one of the best-performers of these last days, with an almost 3x pump from its bottom. This should probably be traded as a memecoin. Be careful shorting this stuff, I got injured by underestimating its strength…

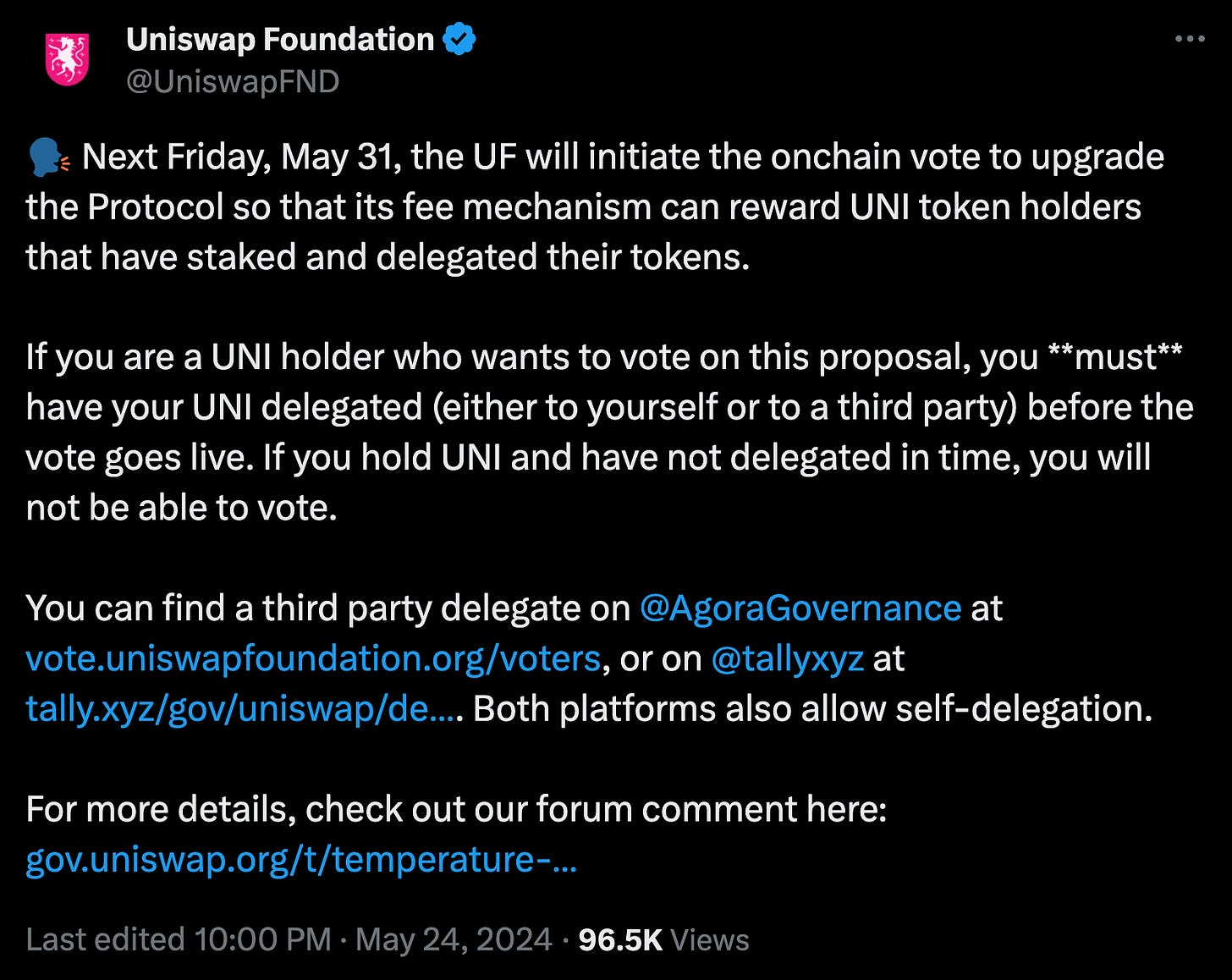

Today Uniswap will initiate the onchain vote to upgrade the Protocol so that its fee mechanism can reward $UNI token holders that have staked and delegated their tokens. Uniswap announced it on May 24, and it lead to a +30% price appreciation of the token.

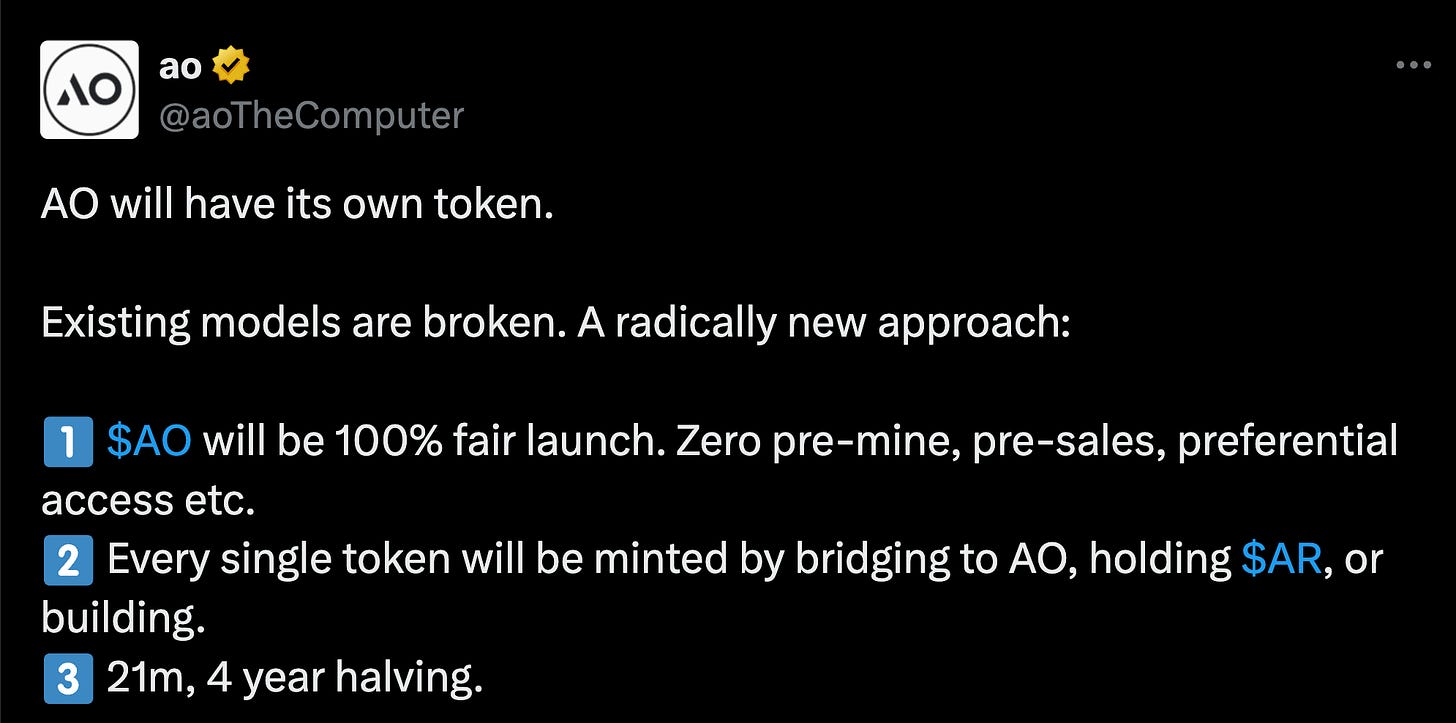

Arweave announced the launch of their new $AO token on June 13 and $AR almost instantly gained +20%. However, I really don’t like when a team launches 2 tokens, so this means that I will probably flip bearish on $AR after the launch of $AO.

$JASMY is up +50% this week. It is a Japanese alt L1 that has quite limited mindshare, and thus has a very idiosyncratic behavior versus the whole market. The chart looks very bullish, though.

$ORDI has been performing very well this week, with a +30% pump. It is now back to the price it first reached in early December 2023, when it was among the hottest coins. Will it lead the BTC ecosystem resurgence in the months to come ?

$CHZ is also up +27% this week, and the catalyst for it is probably the football Euro that begins in around 2 weeks. The last time this happened was in November 2022 when $CHZ pumped before the football World Cup, and then sold the news exactly when it started.

Both $BEAM and $STG had a 2-digit-percentage pump after their listings was announced on Upbit, the leading Korean exchange.

Pixelmon launched their token, $MON. PixelMon was initially an NFT collection that raised $70M and was infamous for the meh quality of the 1st version, that they changed afterwards to look much better. The NFT that everyone remembers is the Kevin character, and it is now traded at a very high price thanks to the special attention it got. $MON is currently trading at $400M FDV, which looks quite undervalued, but it could bleed down before pumping.

$ENS and $ETHFI seem to be the 2 best ETH beta coins in terms of performance, if you exclude memecoins and ONDO (RWA).

Thank you for reading this article,

Cheers,

Viktor.

Ref link shill : My favorite exchange is Bybit, it is where I take most of my perp trades. If you want to start trading there, you can use my referral link by clicking here or use my code 6Y2XOR