Narratives of the week : July 3

$BTC dumped back to range lows, $SOL resists, ETH coins suffer, $ZRO pumps

Welcome to this weekly recap, I am Viktor and you can find me here on Twitter and here on Telegram. Enjoy your reading !

Ref link shill : My favorite exchange is Bybit, it is where I take most of my perp trades. If you want to start trading there, you can use my referral link by clicking here or use my code 6Y2XOR

$BTC and the market overall

In the last edition of my newsletter, $BTC was still trading around $65k and altcoins had just gone through a large move to the downside on June 18 that looked like altcoin capitulation. I wrote : “One possibility would be that $BTC still has lower to go but alts/BTC have bottomed”. So far, that’s exactly what happened since then.

$BTC dumped from around mid-range at $65k to the bottom of the range, and it had a very sharp move down on June 24 that bottomed at $58.5k but bounced during the following days. $BTC went as high as $63.8k but is now back down to the $60K region.

We’ve had a lot of bearish news on $BTC :

Mt Gox creditors expected to receive their coins (or some of their coins ?) in July. If I remember correctly, that’s collectively worth around $9bn $BTC.

The German government started to sell some $BTC that they have seized a few years ago. They are still holding more than 43K $BTC, ie around $2.6bn at current prices.

The US government also sold some $BTC that they had seized in some case, but that was not a very huge amount.

On the ETF flows front, we’ve had non-stop selling until June 24, and we’re currently seeing weak inflows. Stablecoin supply has been staying flat for weeks.

As for altcoins, the June 18 capitulation marked the local bottom on OTHERS/BTC and the chart has been going up since then. My baseline assumption is that this was the bottom and that we won’t revisit it, but this depends on the majors (BTC and ETH) not bleeding down for another 2 months…

ETHBTC is not moving very much, and still trades around 0.055. That’s a bit surprising when you consider the fact that $BTC has a lot of headwind that $ETH is not concerned about (the selling pressure) and that $ETH is going to have an ETF… I still think that the $ETH ETF is not correctly priced in. Balchunas revised his July 2 target for an ETF launch and postponed it to July 8.

ETH related coins : mixed performance

Besides memecoins, the strongest ETH beta coin has been $ENS recently. It broke out of its $28 resistance and went as high as $34, but gave back a lot of the move up in the last 2 days. If you are looking to bid ETH beta coins, this one should definitely be on your watchlist.

$LDO, that was among the strongest coins since mid-May, has unfortunately been attacked by the SEC that filed a lawsuit against Consensys over Metamask swaps and staking services, claiming that Lido and Rocket Pool are unregistered securities. It very negatively impacted the price of $LDO that went from $2.4 to around $1.75 right now.

Many other “ETH related coins” have been suffering, such as $PENDLE (-17% in one day, and -40% in TVL in one week because of less “restaking speculation”), $ETHFI (-25% in a week because of new unlocks coming ?), $DEGEN (-40% in 2 weeks, one of the leading Base coins), $MAV (-30% in 2 weeks), $AERO (-25% in 2 weeks, another Base coin), $XAI (-30% in 2 weeks because of the massive unlocks upcoming).

On the other hand, the ones are resisting well are the DeFi 1.0 coins such as $AAVE, $MKR, $LINK, $SNX, $COMP. $AAVE and $MKR are both revenue-generating machines with low valuations on a relative basis, they could catch a bid if the market starts to pivot to “fundamentals” and is less afraid about the regulatory environment.

As for the ETH memecoins, $PEPE has been weak in the last 7 days and keeps retesting its 0.00001, which is not too good, but I remain very bullish on that coin. The ETH memecoin that has been strong lately has been $MOG : it reached a new ATH at almost $700M market cap, and is still up 2x from June 18 despite selling off in the last 3 days.

Solana and a potential ETF ?

VanEck announced a few days ago that they were filing for a $SOL ETF. I think it probably is more a marketing stunt than something they really think will go through, because there is no CME futures market for $SOL, and the SEC has often used the spot-futures correlation as an argument against approving crypto ETFs.

$SOL reacted with a +7% hourly candle that got retraced in a day. SOLBTC overall has been strong since June 24 though, it is up +18% from then, and same on SOLETH.

$WIF had a capitulation on June 24 when it kissed $1.5, and there was a good trade to take there for a mean reversion back to $2.2. Now it’s under $2 again and the chart looks bearish, but I remain bullish on $WIF for the remaining of the cycle.

The hottest Solana memecoin lately has been $POPCAT, and it’s been following the same strong price action as $MOG. Both of them are cat coins, and both of them are still around the $500M market cap, so they are good candidates to become the next “$WIF and $PEPE”. At least a lot of people on CT have been trying to narrate this story into existence, and I think it’s not too far from the truth.

$ZRO pump after airdrop pattern

One of the most noticeable pumps of the week among “large caps” has been $ZRO : it’s the token of LayerZero and it has been launched very recently. The first days have been “down only”, then stabilization of the price, and then a +50% pump from bottom. Right now, it’s worth around $4bn FDV and $400M market cap, and I would not be shocked to see it pump it higher since it’s still “low” on a relative basis.

I have the same reasoning with $ZK, that I hope could follow $ZRO path :

$BLAST launched

Blast launched its $BLAST token and despite an initial pump in the first few hours, the price is now down -33% from ATH with an overall “small” and disappointing valuation ($2bn FDV) in line with the recent launches (ZK, ZRO). Many people have been disappointed by their $BLAST airdrop, especially the $BLUR farmers, and $BLUR lost -12% in 2 hours after the airdrop amount announcement, and is down -20% in a week.

Trump - Biden debate

Trump and Biden had their first debate around a week ago and it was a disaster for Biden that really looked senile… and it ended up being a disaster too for the “PolitiFi memecoins” since $BODEN went down around -50% right after the debate and -96% from its top… $TRUMP suffered too, it’s down -40% since that debate, and worth around $250M market cap now. I think this might be a good opportunity to long it again in that $4-$5 range.

What else happened in the altcoin market ?

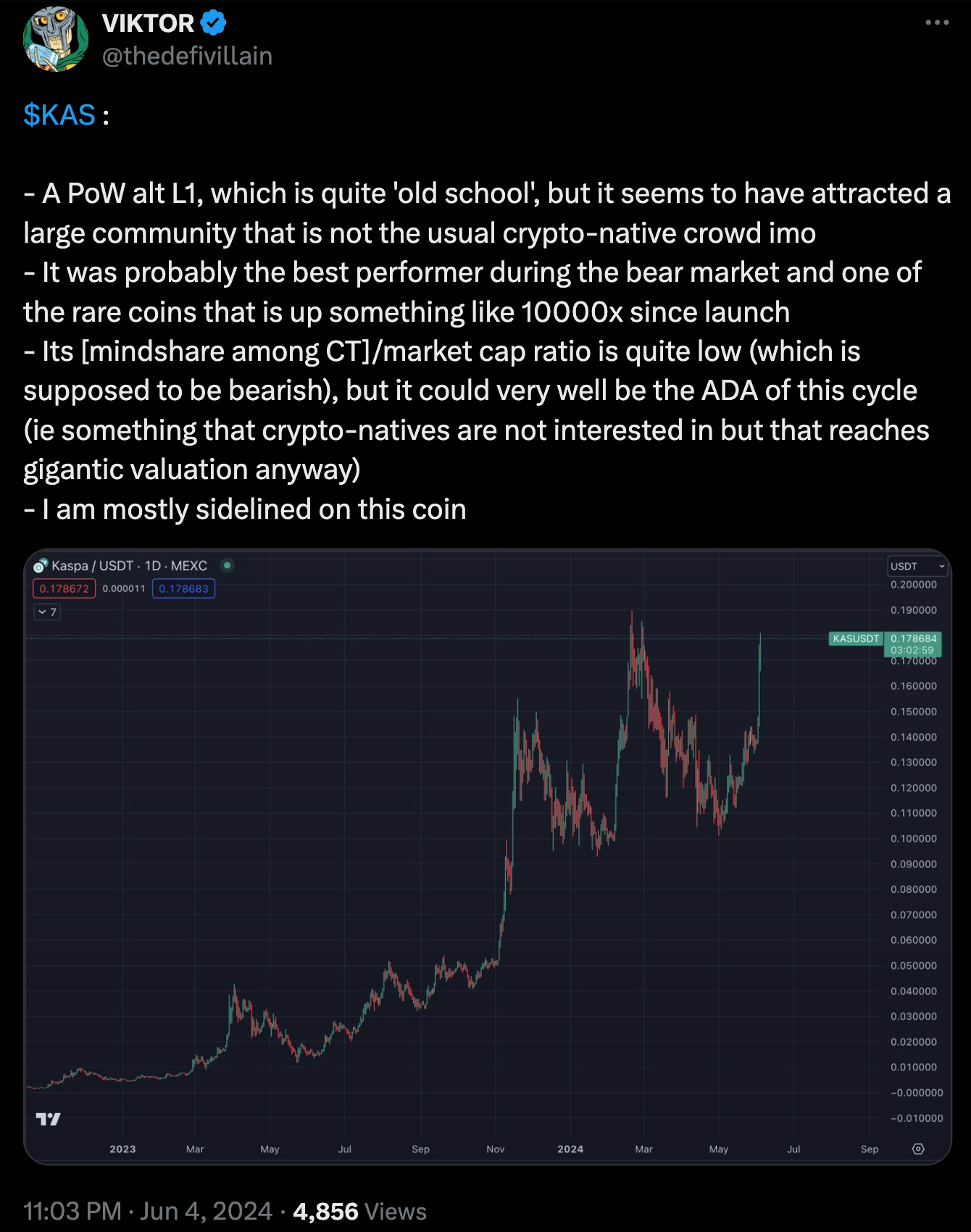

$KAS is one of the strongest coins in the top 100, it reached a new ATH a few days ago but was rejected once again below $0.2.

$AVAX has also been surprisingly strong this week, it could simply be a side effect of $SOL outperforming and having potentially and ETF in sight. Even if the SOL ETF is very unlikely, if $SOL gets one, maybe $AVAX would be another logical candidate.

Many of the high FDV low float coins have been suffering a lot lately : $TIA, $SEI, $ENA, $PIXEL, $ALT have all been making news lows recently.

A few smaller memecoins have performed well lately : $BILLY, $RETARDIO, $MUMU, $SPX, $JOE for example.

Thank you for reading this article,

Cheers,

Viktor.

Ref link shill : My favorite exchange is Bybit, it is where I take most of my perp trades. If you want to start trading there, you can use my referral link by clicking here or use my code 6Y2XOR

which is your favourite politifi memecoin?