April recap : narratives, best-performers, and coins to watch

Red month, halving, new coins bad

Welcome to this monthly recap, I am Viktor and you can find me here on Twitter and here on Telegram. Enjoy your reading !

Ref link shill : My favorite exchange is Bybit, it is where I take most of my perp trades. If you want to start trading there, you can use my referral link by clicking here or use my code 6Y2XOR

Main events that happened in April :

One of the main events of the month has been the two consecutive dumps on April 12 and April 13. Both of the dumps led to liquidation cascades. $BTC went from $71k to $67k to $64k in 2 days (with a wick lower), which was a reasonable drawdown, but altcoins got completely decimated on these two moves, with $800M longs liquidated on both days, and half of the $20bn altcoin open interest evaporated. The origin of the first dump is unclear, but the second was news-driven since it happened after Iran launched drones against Israel, and people started to panic about WW3. The sentiment went so bad that even GCR came back from its Twitter hiatus to tell people not to sell the bottom.

The main token launch of the month has been $ENA, the governance token of the Ethena protocol, which is basically running a basis trade and distributing the yield to its staked $USDe stablecoin holders. $ENA launched at the beginning of the month, right before the market pumped for a week, so it benefitted from ideal conditions and went from $0.6 to $1.5 in 10 days, reaching an impressive max FDV of $24bn. Ethena was also involved in a drama between Aave and Maker / Ethena / Morpho, because Maker is issuing $DAI loans against $USDe collateral using the Morpho lending protocol, and Aave judged that it was a risky move for $DAI. Ethena is scaring a lot of people who are seeing it as the next Luna, but the model is completely different so even if there are risks involved, the death spiral is not really an option.

$BTC halving happened on April 20. The Runes protocol (an improved version of Ordinals) also launched after the halving. Price-wise, the halving has been a non-event on $BTC, as usual.

Uniswap received a Wells notice from the SEC on April 10, and $UNI dumped -20% in 24 hours. It kept dumping afterwards because the whole market crashed, but this event makes $UNI even less interesting to long during this cycle (as a consistent underperformer against BTC, it was already uninteresting price-wise before that in my opinion, even if it has great fundamentals). The “fee switch” pump has now been completely retraced on $UNI.

$HBAR 2x’ed (despite having a large multi-billion market cap already) in around 12 hours after Hedera posted a tweet implying that they were working on RWA with BlackRock. CoinTelegraph tweeted a few times that the tweet was ‘misinterpreted’, because the partnership with BlackRock is probably more nebulous that one would have thought, and this contributed to the price collapsing afterwards, in a nice “Burj Khalifa” pattern.

Hong Kong spot $BTC and $ETH ETFs have been approved in April, and started trading on April 30. The volume on the first day of trading was decent on a relative basis (knowing that the Hong Kong ETF market is waaay smaller than the US one), but it is basically negligible overall for the price of $BTC.

EigenLayer announced the launch of its token which will happen on May 10th. The announcement sparked controversies for a few reasons : the allocation to the team + investors seems large / people have been slightly disappointed by their airdrop amount / the ‘airdrop’ tokens will not be transferable at launch / a lot of countries have been geo-blocked from claiming their tokens. $ETHFI pumped +40% (and ETHBTC pumped too) right before the announcement of EigenLayer, some people knew that it was coming, while others followed the rumors.

Main narratives of April :

Red month :

The main narrative of the month was probably that it was a red month, with $BTC down -15%, $ETH down -17%, and TOTAL3 (altcoins including stablecoins) down -21%. The main dump was on mid April and it was concentrated on altcoins, but $BTC had another blow on April 30, that pushed it for the 5th time to the $60k support that finally broke down on May 1st. The BTC ETF flows completely stabilized in April, and we even saw a lot of outflow days. May 1st was a massive -$560M outflows day, and also the first outflows day for $IBIT, the BlackRock product. Funding rates which have been extremely elevated in March, did come back to neutral (10% annually) or even below neutral levels in April. Ethena OI probably had an impact by pushing the funding rates lower.

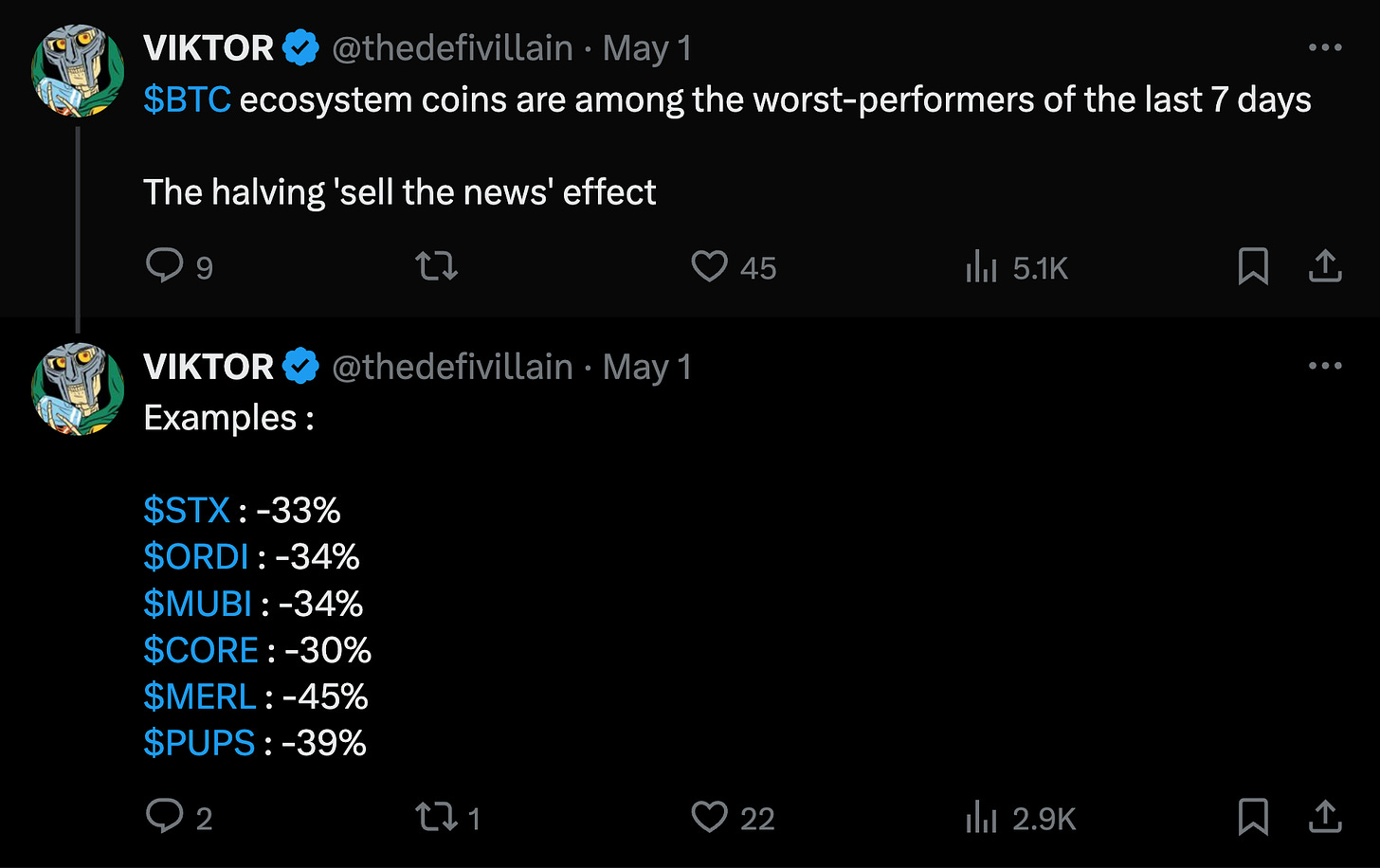

BTCfi and the halving :

The halving has been an important catalyst this month for the whole Bitcoin ecosystem, especially all the Ordinals/BRC20 related stuff (with the Runes protocol launching post-halving). For example, $MUBI, the bridge between Bitcoin and other blockchains, pumped 2x between the beginning of the month and the halving, before retracing all its gains. $ORDI also outperformed the market by +30% during the first week of April. Other beneficiaries of this catalysts are Bitcoin Puppets (one of the main ordinals collection), $PUPS (a BRC20 token supposed to migrate into Runes that went 30x in 2 weeks before dumping -60%), and $WZRD (a similar coin that 100x’d). The $PIZA BRC20 token also pumped almost 10x. But BTCfi ends up being one of the worst-performing category of the month, because it sold off rather hard after the halving.

$TON :

$TON (Telegram coin) has been one of the hottest coins during the first part of April, and even reached a $40bn FDV at its top. It topped against $BTC on April 19, which corresponds to the day of the Pavel Durov’s (Telegram CEO) talk in Dubai at the Token2049 conference, where they announced that USDT would be deployed on the TON network. Telegram is a huge web2 business so it makes sense that its valuation can become very large, but its mindshare / market cap ratio seems rather low, and it is a coin that tends to move on its own, without depending too much on the crypto market movements.

New coins bad :

For a long time since November 2023, buying new coin launches was a great idea since they usually had at least an initial pump. Now the meta has reversed : almost all the new coins launched in April have been going down only. Here are some of the drawdowns top to bottom we’ve seen :

$W : -70%

$SAGA : -60%

$OMNI : -50%

$TNSR : -60%

$MERL : -65%

$ZEUS : -65%

$PRCL : -50% (after a pump though!)

This happens in the broader context of an ongoing debate about the low float high FDV playbook which has become the norm for any major token launch. People are realizing that these new coins offer very limited upside once they are out in the market since their FDVs are already so high, and the overall feeling is that retail becomes exit liquidity for VCs that are up 500X on their initial investment.

This should simply lead more and more people towards buying memecoins that don’t have this problem at all because they are fully diluted, while being relatively ‘cheap’ valuation wise…

Memecoins :

$POPCAT dumped -80% from early to mid April, but then had a massive 5x reversal, and has become the leading ‘cat coin’ above $MEW. Dog coins have always been the major memecoins, and it makes sense to bet on the idea that one cat coin will stand out and reach at least a $1bn MC, or that the cat coins / dog coins market cap ratio will increase.

Unsurprisingly, the best-performers of the month overall have been on-chain memecoins, because they are small enough to have idiosyncratic moves versus the overall crypto market. On Ethereum, we’ve had $APU (a variant of $PEPE) up +1100%, and $ANDY up 100x. Of course, these are tiny markets that are not necessarily relevant, but it’s worth noting that there will always be 10x opportunities in crypto, even when the overall market is red. Other noticeable performers are some of the 2023 ETH memecoins that were hot when everything was dead after summer 2023, and that never really took off when the bull market properly started : $JOE had +130% gains in April (and kept pumping in early May), and $SPX had +72% gains. $BITCOIN, $KEKEC and $SMURFCAT are in the same category, despite an average month. I mention them because most of these have really small market caps and yet managed to remain alive months after their launch, while some Solana memecoins are able to reach 9-fig valuations in a few days, so they could offer a good risk-reward going forward. There is also $OX, the coin of the exchange Ox.fun run buy Su Zhu and Kyle Davies, that is very stable at a relatively ‘small’ market cap.

Some Solana memecoins had a good month too : +84% for $PONKE, and $BODEN reached a $700M market cap at top. $USA also went up almost 30x from $1.5M MC to $45M MC. This could be the leader of a new “country memecoin narrative”, especially with the Olympics and then the 2024 elections coming.

From the mid-April dumps, the best-performing category by far has been memecoins, with $BONK for example being up 2x from its locals lows, and $PEPE up +60%.

Other coins :

Over the month, a lot of the ‘top-performers’ are simply coins that dumped less than the others, and these are low beta coins that usually underperform on the way up, such as the dino coins : $TRX, $XMR, $XRP for example. These are good hedge shorts when the market is trending upwards.

Other coins that were showing some strength despite the dump are : $BNB (up only since the $4bn fine news), $ONDO (leader of the RWA narrative), $NEAR (L1 x AI), and $AR (now considered as a great AI coin because of the launch of their AO project).

The Milady, Remilio, and Schizoposter NFT collection all saw their floor prices go up in April as they seem to often be eligible for the airdrops of new coins. On the other hand, BAYC (Bored Apes) and MAYC floor prices reached new lows in April, but managed to bounce strongly afterwards.

Best-performer list :

Best-performers among large caps in April :

$ENA : +30%

$NEO : +3%

$TRX : -3%

$BNB : -5%

$TON : -5%

$XMR : -7%

$NEAR : -15%

$BTC : -15%

$ETH : -17%

$HBAR : -19%

$XRP : -20%

$BONK : -20%

$AR : -22%

$LTC : -24%

$PEPE : -24%

$ONDO : -24%

$SHIB : -27%

Smaller coins worth noting that had a good performance in April :

$ANDY : 100X

$USA : 30X

$APU : +1100%

$WZRD : +900%

$PUPS : +600%

$PIZA : +185%

$JOE (memecoin) : +130%

$GOG : +90%

$PONKE : +84%

$BNX : +73%

$HIGH : +50%

$SFP : +5%

$MAGA : +4%

Thank you for reading this article,

Cheers,

Viktor.

Ref link shill : My favorite exchange is Bybit, it is where I take most of my perp trades. If you want to start trading there, you can use my referral link by clicking here or use my code 6Y2XOR